CHAPTER 2: CLIMATE CHANGE: FROM AMBITION TO ACTION

Contributed by Dr Tilak K. Doshi, Managing Director, Doshi Consulting

Under the Paris Agreement, the 194 Parties to the United Nations Framework Convention on Climate Change (UNFCCC) committed to shifting the world’s course towards “sustainable development” and “holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels.”

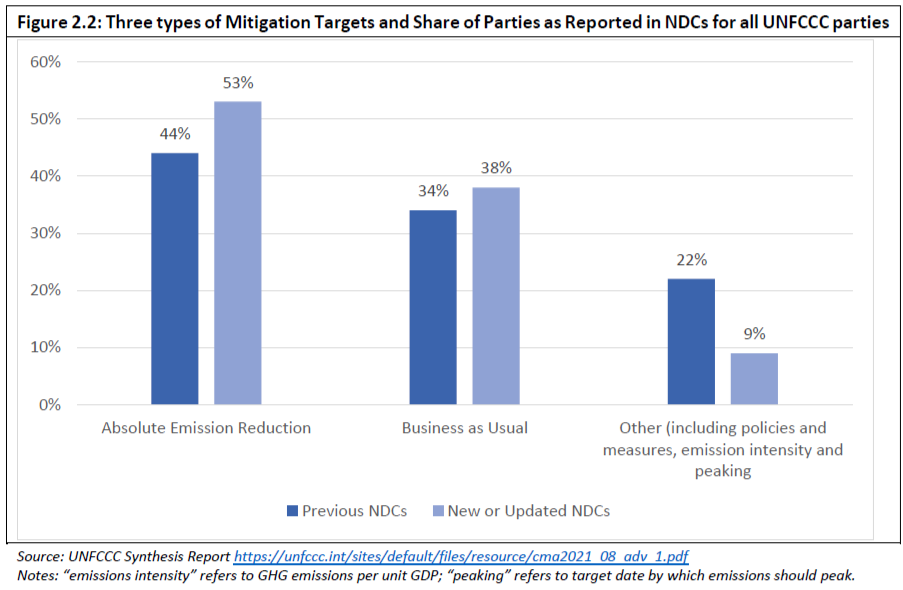

Parties to the upcoming UNFCCC COP26 summit in November have committed to a range of GHG emission reduction targets. National Determined Commitments (NDCs) presented by Parties included absolute reductions of emissions from a base year, reductions from a hypothetical “business as usual” (BAU) trajectory over the 2020 – 2030 period or reductions in emissions intensity per unit of GDP and “other policies and measures”. The most common emission reduction target (43%) was that expressed as a planned reduction from a projected “business as usual” outcome. Absolute emission reductions relative to a base or reference year or absolute quantified reductions without reference to any base year was the next most popular (35%). Just over a fifth of all NDCs chose other types of targets including reductions in emission intensity, target dates for planned peak emissions, and a range of other policies and measures or a combination of these.

Promoting renewable energy generation were most frequently mentioned by Parties, followed by measures for energy efficiency improvement. Almost all Parties outlined mitigation targets in specific priority areas, such as energy supply, transport, buildings, industry, agriculture, LULUCF and waste. In comparison with previous NDCs, new or updated NDCs communicated an increased focus on adaptation planning. Adaptation priorities for most Parties, according to the NDCs, focus on food security and production; terrestrial and wetland ecosystems; human health; freshwater resources; key economic sectors and services; disaster risk management and early warning; human habitats and urban areas; coastal areas and sea level rise; ocean ecosystems; and livelihoods and poverty.

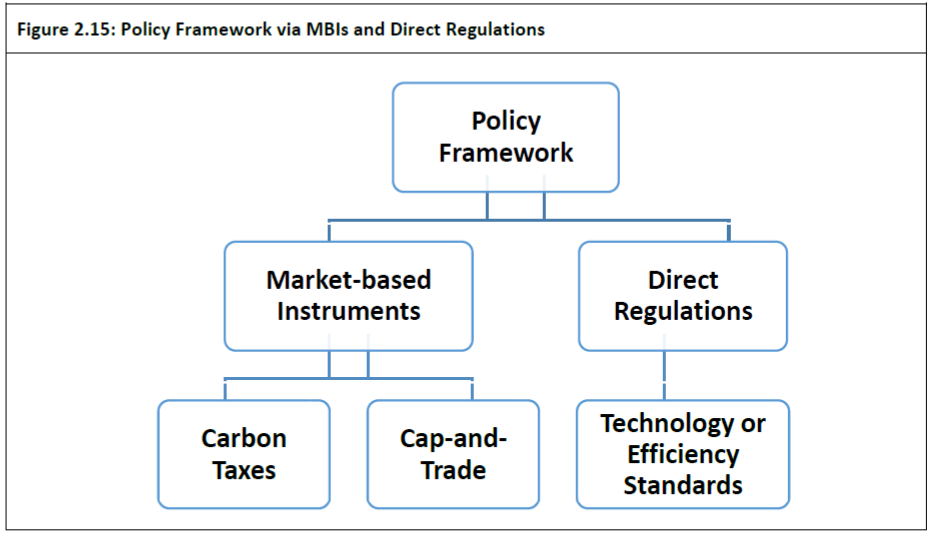

Most NDCs indicated support for renewable sources, particularly for solar and wind technologies, in the electricity sector; promotion of electric vehicles in the road transport sector; and enhancement of energy efficiency across the industry, residential and other sectors. NDCs commonly identified markets and market-based incentives (MBIs) such as emission taxes or “cap-and-trade” of emission certificates as a means of efficient decarbonization by putting a price on emissions.

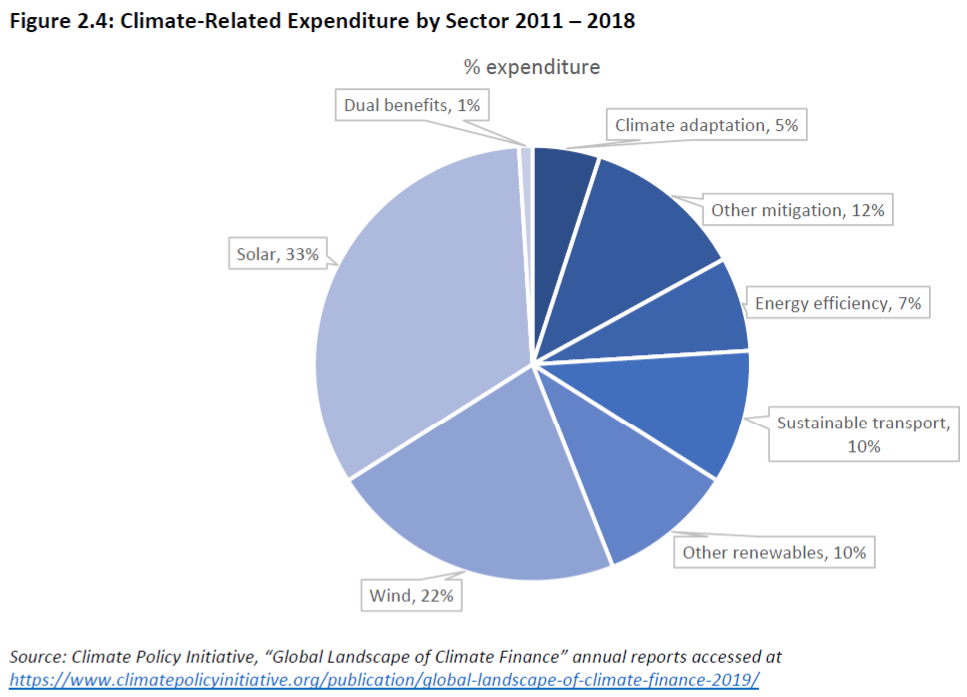

Turning to actual government climate-related expenditures over the past several years (2011 – 2018), the most striking feature is the overwhelming amount spent on just two renewable technologies -- solar and wind energy. The other striking feature of the spending pattern is that climate adaptation only accounts for 5% of total government climate-related expenditure. Empirical evidence suggests that by overemphasizing climate mitigation efforts, the UNFCCC and COP agreements such as the Kyoto Protocol and the Paris Agreement have led to a bias against investment in climate adaptation. This suggests the importance of policy cooperation among APEC member economies designed to bring about greater attention to climate adaptation efforts.

Advanced APEC member economies such as Australia, Japan, New Zealand and the US have had relatively rapid growth in renewable energy as a share of total power generation which is in excess of the world average in 2020. Some developing APEC members such as Mexico, Chile, Malaysia, Thailand, and Vietnam exhibited extremely high rates of growth in both wind and solar power generation, significantly in excess of the global average growth rate in 2019 due mainly to the small base that renewable energy had in total power demand in 2018. Over the decade, despite the high percentage increase in renewable power generation in the developing APEC member economies, incremental power demand was overwhelmingly met by fossil fuels (in excess of 80%). Meeting the development and poverty alleviation objectives of these economies - where per capita electricity consumption rates are low and universal access to grid electricity is still lacking -- are policy priorities that are not likely to be compromised at the negotiations at COP26.

In formulating and implementing regulations to promote energy efficiency initiatives, it is critical that all such new regulations meet the tests of unbiased cost-benefit analysis. The guiding principle to policy interventions is that they must improve societal welfare. Many economies and multilateral organizations such as the Organization for Economic Co-operation and Development (OECD) and APEC have developed best practice regulatory guides. These guides highlight similar key themes: the need to clearly define the policy problem and the rationale for government intervention; consideration of a range of policy options, including a do-nothing approach; and assessing the full range of social costs and benefits of the proposed policy options.

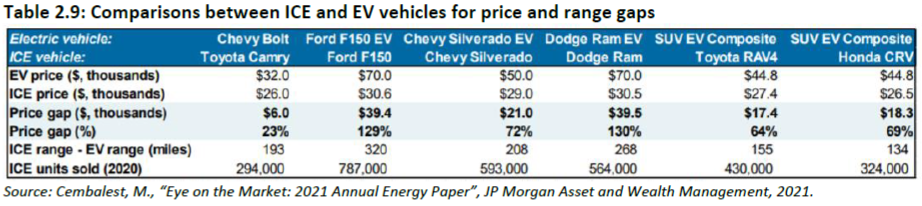

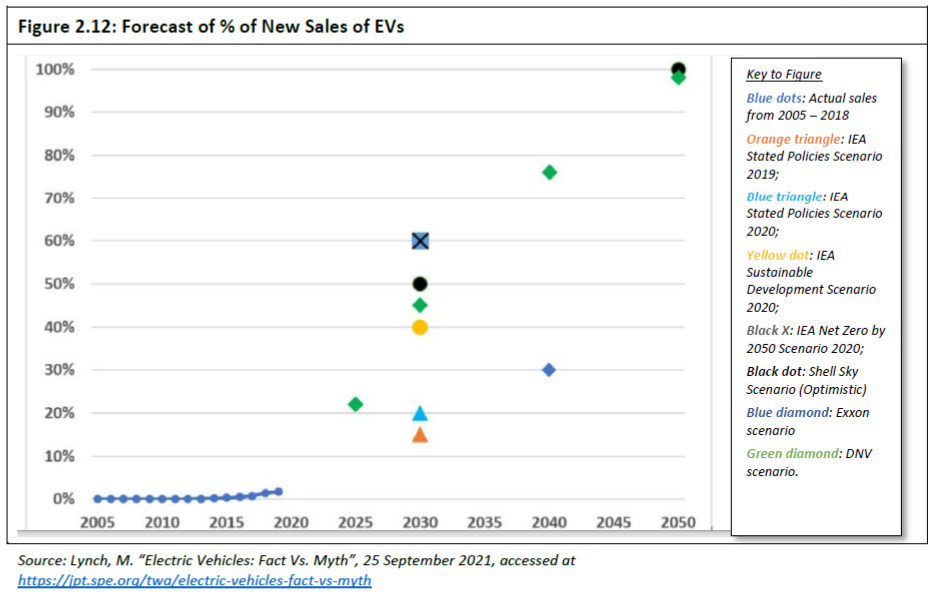

Many APEC member economies have adopted policies such as subsidies for electric vehicles (EVs), higher taxes for fuels such as gasoline and diesel, taxes on internal combustion engine (ICE) vehicles, tax-payer funded charging stations and other policies to encourage electric vehicles (EVs). There is currently much optimism about the prospects for EVs to replace ICE vehicles in passenger transport. However, there are also more skeptical views that suggest the disadvantages of EVs such as limited driving range, long charging times and high costs will limit the uptake of EVs. If EVs constituted a significant percentage of the global vehicle fleet from its very low levels now (less than 1%), research suggests that the demand for the many mineral commodities and rare earths would reach untenable levels. Cooperation among APEC member economies to ensure transparent and adequate standards for human and labor rights and local environmental pollution controls to handle the mining and processing of such minerals and rare earths will be crucial.

The implementation of carbon capture and storage or sequestration (CCS) technology to mitigate CO2 emissions has much appeal. However, the technology for CCS is far from demonstrated commercially and there exist few projects in the world today. While the technology to achieve carbon capture and storage exists, the economics are proving prohibitive. The key hurdle is the 15–30% of energy that is consumed to capture CO2 from the power plants. Best practice methods from economies such as the US which has extensive experience in enhanced oil recovery using injected CO2 may well prove beneficial to other oil and gas producers in APEC who have the requisite geology and upstream oil and gas activity.

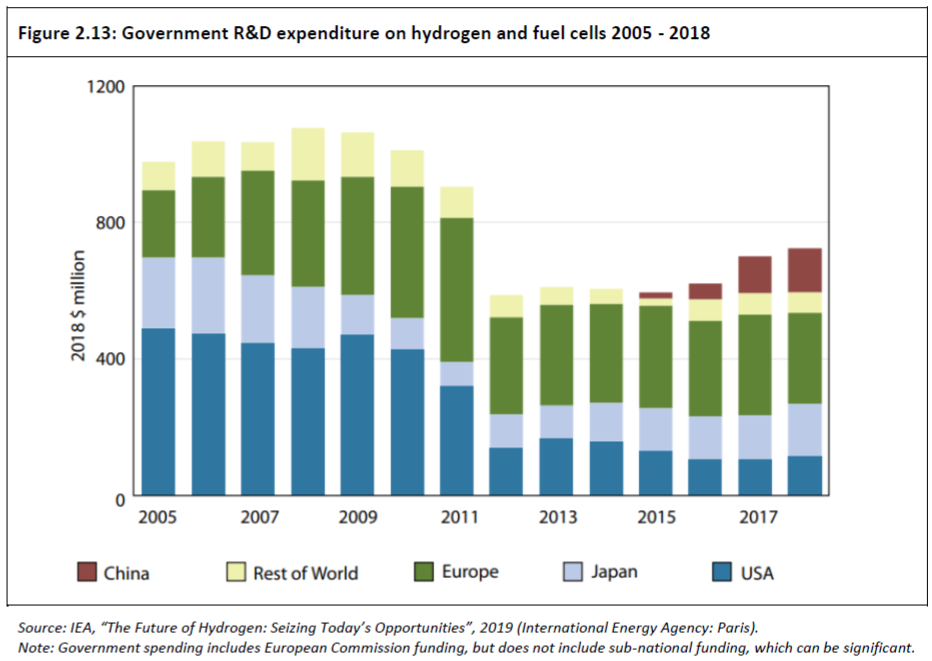

International enthusiasm for the “hydrogen economy” to mitigate CO2 emissions is very high and APEC member economies such as Japan and the US are leaders in R&D investments in this area. However, extracting, transporting, and using hydrogen to reduce carbon emissions costs more than the human welfare benefits predicted to accrue in the long run future. Early projects carried out by Japan to import blue and green hydrogen from the Middle East will provide its fellow APEC member economies data on the safety and economic viability of utilizing hydrogen in various end-use sectors to replace fossil fuels.

Increased ambition expected of Parties under the Paris Agreement at COP26 lies in the implementation of Article 6 of the agreement which calls for “voluntary cooperation” among Parties. Article 6 could also establish a policy foundation for international emissions trading systems, which could help lead to regional and global prices on carbon. Joint implementation of projects between advanced and emerging economies would offer the benefits of lowering costs of emission reduction since it is typically cheaper to curb emissions in emerging. It would also lead to technology transfer and financing opportunities for the developing economies that lag behind on decarbonization. Carbon market mechanisms can allow businesses to trade both carbon credits and carbon offsets within economies and across borders.

It is well established that market-based instruments have more positive effects on firm productivity than discretionary “command-and-control” mechanisms. MBIs to promote carbon pricing in the transition to low-carbon energy systems provide firms with more flexibility in meeting low-carbon goals than non-MBI approaches. Climate change policies via MBIs promote productivity gains across the economy as least productive firms drop out. The conventional role for government in skills development and re-deployment, providing information on newer technologies as a public good, improving access to finance for SMEs based on durable and credible carbon-pricing policies cannot be over-emphasized.

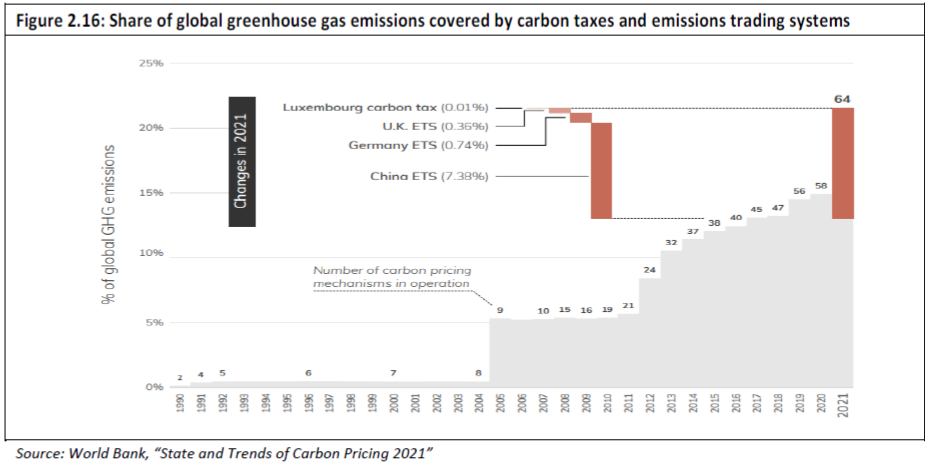

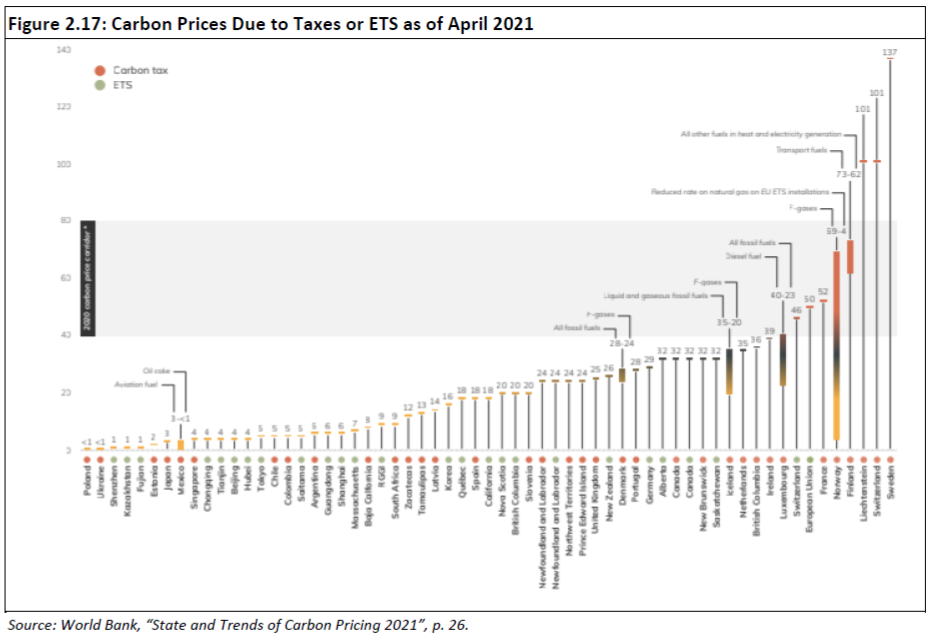

As of early 2021, there were 64 carbon pricing initiatives. The share of global emissions under carbon pricing is 21.5%. The carbon prices in these different initiatives range widely, from less than $1/tCO2e to over $130/tCO2e although in most cases carbon prices are relatively modest. Less than 4% of global emissions are covered by a carbon price at or above the range US$40 - 80/tCO2e – the range which the World Bank suggests is needed in 2020 and $50 – 100/tCO2e by 2030 to meet the 2°C temperature goal of the Paris Agreement. There is evidence of a growing engagement by private businesses in carbon pricing. The corporate sector is increasingly using internal benchmark carbon prices as a tool for business decision making and to identify low-carbon investment opportunities.

While participation by the private sector in using internal carbon prices to guide investments is important to promote low-carbon energy transitions, the context in which private sector participation is successful depends on government policy stability and long-term credibility. APEC member economies could play a lead role in carbon pricing by establishing region-wide carbon markets to promote emission mitigation in a market-friendly manner. Indeed, the group could do much to advocate market-based instruments over discretionary regulations and policies to achieve emission mitigation objectives in a more cost-effective manner.

There are two other dimensions regarding private sector investments in carbon emission commitments. First, many firms have made public commitments to account for their emission profiles, including those from “scopes 1, 2 and (partially) 3” which is discussed in Section 3c. Secondly, firms are under increasing oversight and pressure by financial intermediaries such as private banks and hedge funds but also by Central Banks and multilateral development and financial institutions such as the World Bank and the IMF (discussed in Section 4d and 4e).

APEC member economies could do well to liaise and adopt compatible carbon market initiatives that allow for carbon credits and offsets to support fungibility and liquidity. Aligning different carbon pricing systems once they are operational is difficult. Different carbon pricing systems and governance institutions may become too deeply entrenched for easy harmonization of rules to be achievable. In this context, the concept of carbon emission trading hubs might provide a more promising approach than “top-down” multi-lateral harmonization agreements. Regional markets with a wide range of heterogenous economies at various stages of development, such as the APEC region, would improve the efficiency and liquidity of trade in carbon certificates. Trading hubs in financial and trading centers such as Hong Kong (China) and Singapore would help in the development of regional voluntary carbon markets. These hubs would traverse the developed economies such as Australia, Canada and Australia as well as the largest developing Asian economies with low per capita emissions such as India, Indonesia and Vietnam.

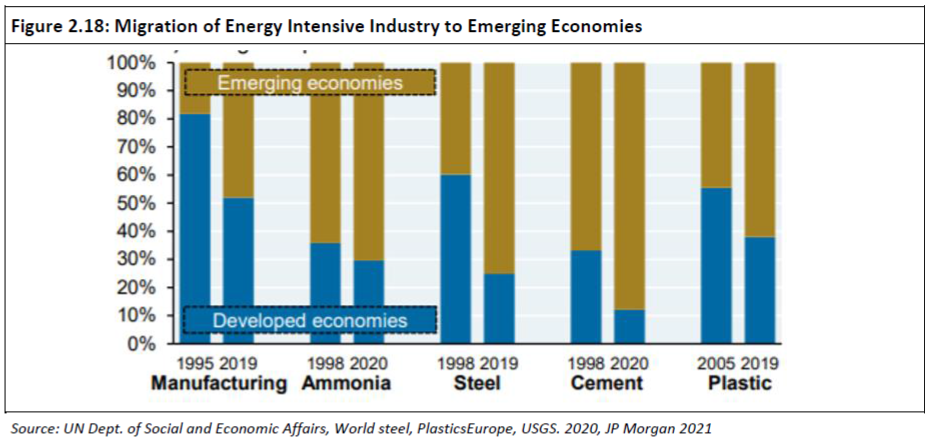

Among the most important policy concerns challenging the introduction of carbon pricing around the world is the issue of “carbon leakage”. Carbon leakage occurs when differences in emission regulations across jurisdictions can lead to re-location of carbon-intensive industries away from those jurisdictions which have tighter restrictions on carbon emissions and towards those that have either laxer or non-existent emission regulations. Carbon leakage will doubtless also be a central issue at the UN’s 26th Conference of Parties (COP26) when it meets in November. Carbon trade tariffs are being proposed in a number of legislative and political forums as a means to mitigate competitiveness concerns and carbon leakage, and to help encourage jurisdictions with laxer emission regulations to adopt higher mitigation standards for energy-intensive exports. The actual design details of any particular carbon border adjustment mechanism (CBAM) legislation will determine whether such unilateral moves are WTO-compliant. The WTO arbitration and appeals process may not be able to resolve trade complaints promptly and in good order. The threat of tit-for-tat reprisals and the imposition of further trade barriers by those outside any “climate club” holds serious consequences for the outlook of the multilateral rules-based trading system. APEC member economies could constructively strive for a cooperative outcome that avoids such threats to free trade and reciprocity norms under the aegis of the WTO.

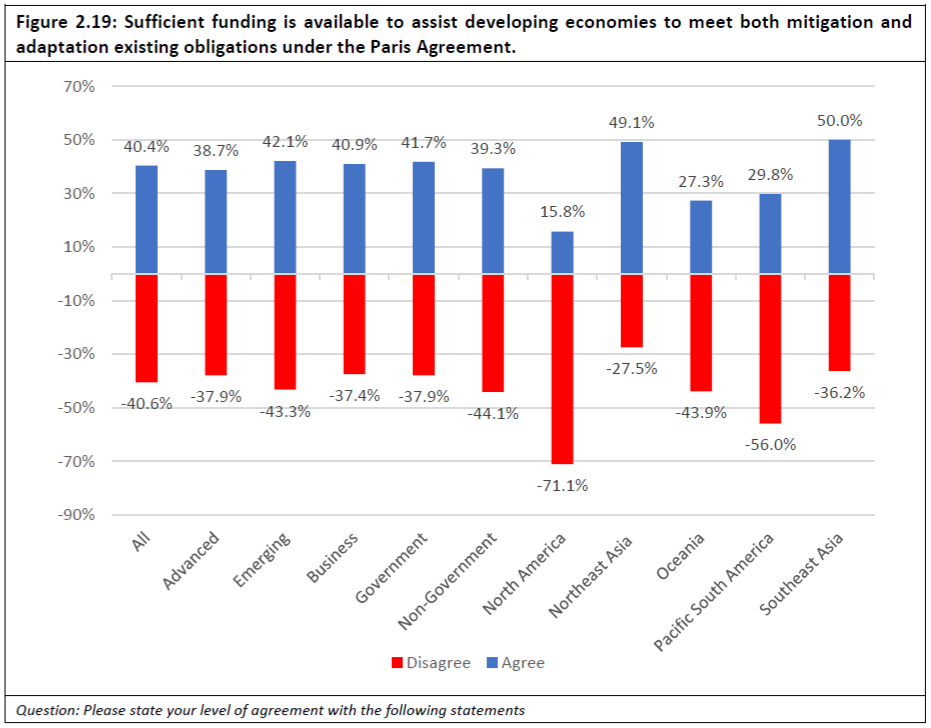

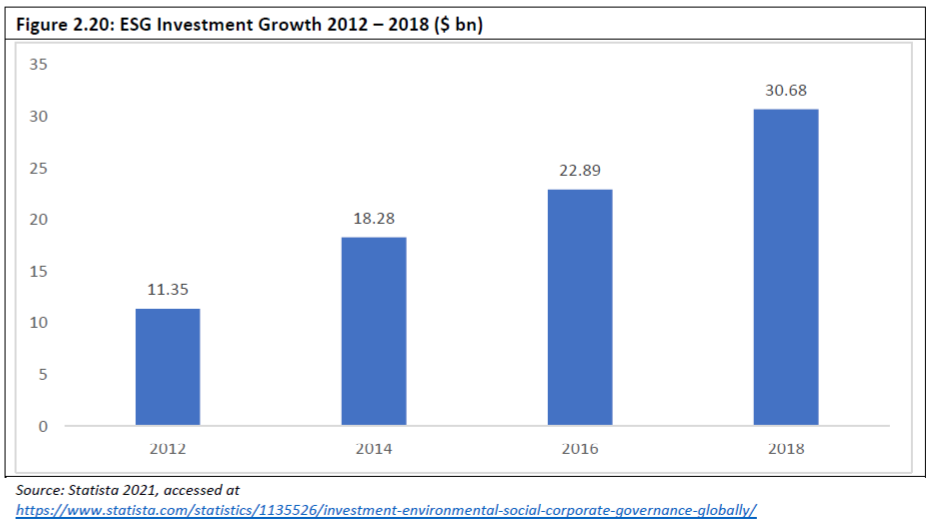

Estimates for “green finance” requirements vary widely and the investments required to support “transition” of the global energy system are immense. An agreement on climate change finance is now viewed as critical to the success of the upcoming COP26 conference to be held in Glasgow in November 2021 and the financing gap remains a key obstacle to the success of the talks.

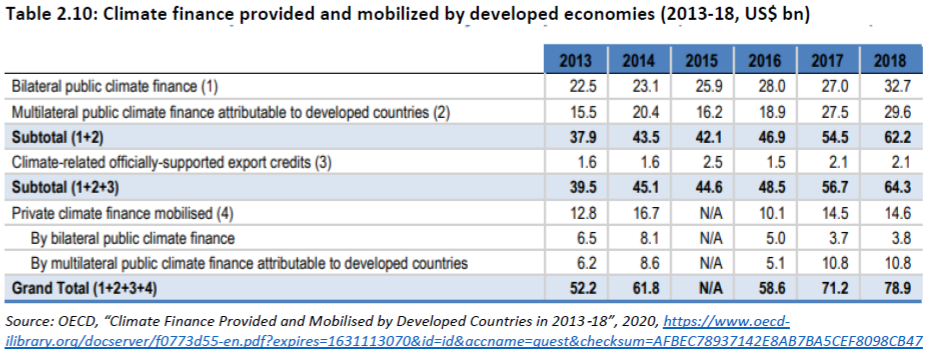

There is a large literature on what has been broadly termed “green finance”, the respective roles and importance of public and private sectors, and the variety of financial instruments deployed. However, there is no precise and commonly accepted definition of the term. Most green finance portfolios tend to emphasize mitigation despite a recognized need to increase adaptation finance. Of the $78.9 billion in climate finance transferred by high income economies in 2018, only 21% was spent on adaptation. APEC member economies could play a strong and positive role as a group in supporting adaptation finance at the COP26 summit.

The lack of clear criteria in the classification of the activities underlying green finance and comparability across economic sectors, industries and projects increases the uncertainty associated with financing investment decisions and distorts or obviates clear policy signals. There is a critical need for harmonization of green finance standards to lower transaction costs, enhance the efficiency of financing investments which support seamless investment flows across jurisdictions, and support member economies’ climate mitigation and adaptation policies and projects. APEC member economies which overwhelmingly support SDG goals could play a role in promoting harmonized green finance standards and definitions.

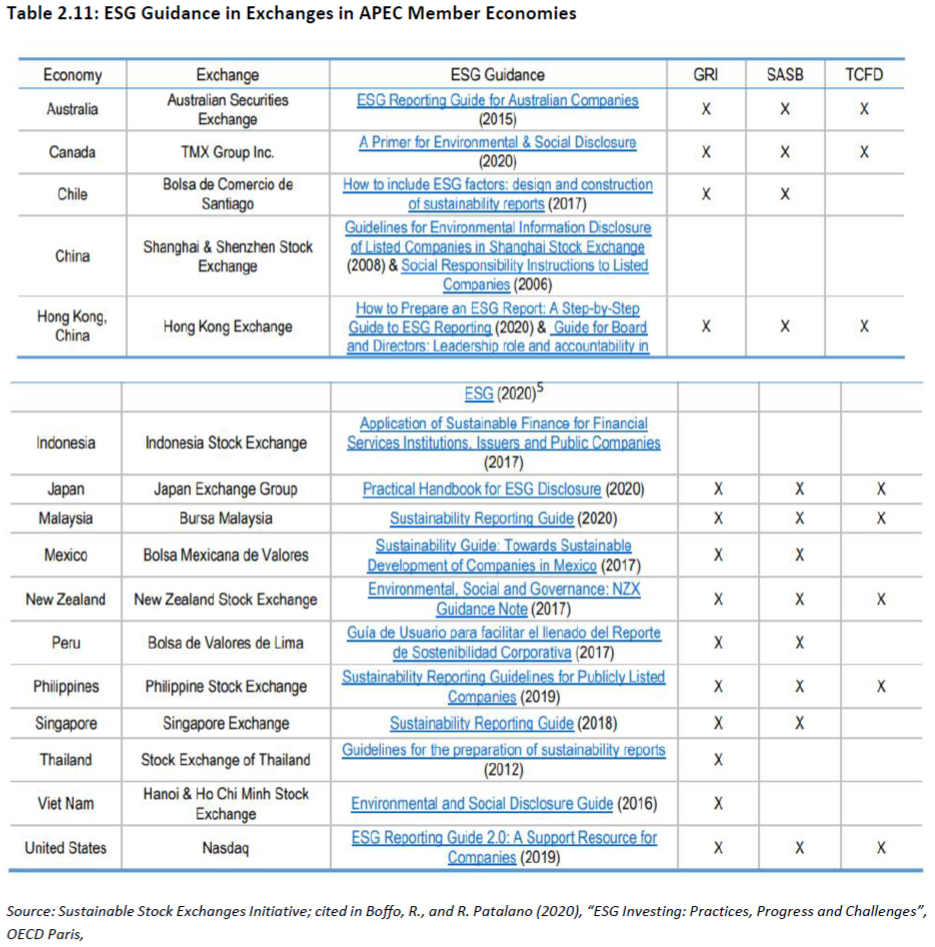

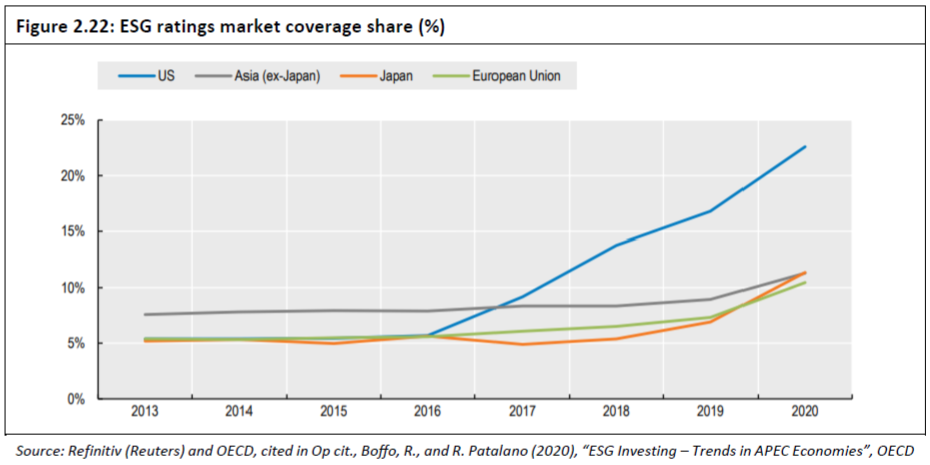

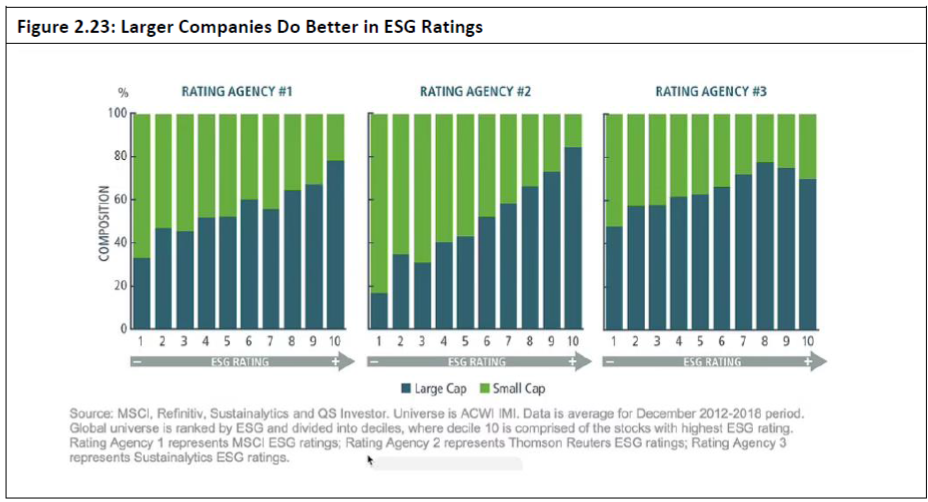

The empirical evidence provides little support to suggest that ESG ratings provide adequate measures of “green finance” for climate change mitigation and adaptation efforts. APEC regional economies can play a crucial role in ensuring that ESG investments lead to real initiatives in emission mitigation and climate adaptation efforts.

The publicly articulated positions of key players from both developed and developing economies are widely divergent and fraught with tensions over a host of unresolved issues. Only eight of the G20 members have submitted significantly more ambitious climate targets. Australia, Brazil, China, India, Saudi Arabia, South Africa, and Russia, have yet to do so. The BASIC bloc of leading developing economies which comprise Brazil, South Africa, India, and China, have argued consistently that industrialized economies were able to get wealthy before carbon emission reductions were called for and that developing economies cannot be expected to make sacrifices that would put their legitimate aspirations for economic development at risk.

The largest emitters among the developing economies have signaled that the achievement of their targets has conditional elements which include access to enhanced financial resources, technology transfer and technical cooperation, and capacity-building support. The prospects for trade tariffs being imposed on developing economies’ exports of energy-intensive goods by the EU, US and other developed economies are also of great concern to many economies that may be outside of a putative “climate club”.

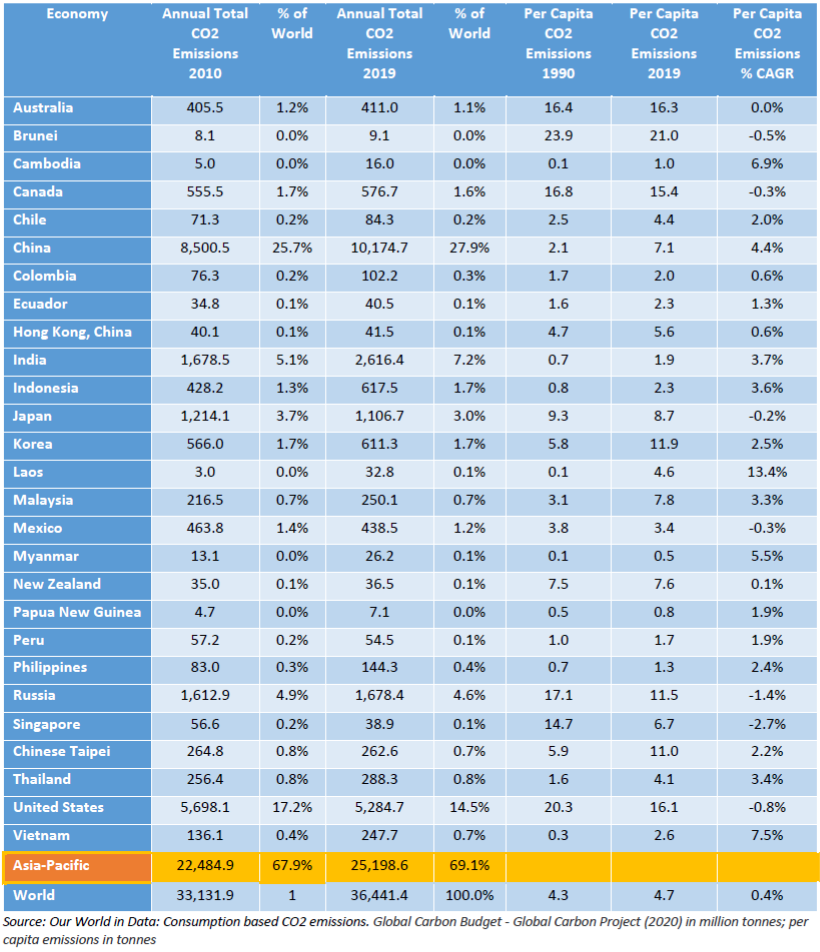

The vast difference in per capita CO2 emissions between developed economies such as Australia, Canada and the US which stand at over 15 tons and those of developing economies such as India, Indonesia, Mexico, the Philippines, Thailand and Vietnam at the other end of the spectrum at less than 3 tons (i.e. lower by a factor of five) suggest that the call for all economies to reduce emissions at COP26 will be received with much reservation regarding equity and historical responsibility. In the wake of debilitating economic lockdowns with the covid pandemic, the key policy challenges for many developing economies lie less with concerns about increasing CO2 emissions caused by economic growth than with re-invigorating economic growth in the first place so that the objectives of poverty alleviation and meeting popular aspirations for better standards of living are not compromised. It would be appropriate for APEC member economies to propose climate mitigation and adaptation policies and measures at COP26 which are consistent with the rapid resumption of economic growth and free trade to meet broadly-shared development and environmental goals.

2. Paris Agreement: Nationally Determined Commitments

APEC’s Putrajaya Vision of an ‘open, dynamic, resilient and peaceful Asia-Pacific community by 2040, for the prosperity of all our people and future generations’ includes as one of its drivers strong, Balanced, Secure, Sustainable and Inclusive Growth: Central to this is the promotion of ‘economic policies, cooperation and growth which support global efforts to comprehensively address all environmental challenges, including climate change, extreme weather and natural disasters, for a sustainable planet.”’

Central to these global efforts is the Paris Agreement on Climate Change. The purpose of this study is to identify key areas for regional cooperation in climate mitigation and adaptation initiatives. Specifically, it will cover three topics:

- Paris Agreement Nationally Determined Commitments (NDCs)

- Carbon Markets, Carbon Prices and Carbon Trade Border Adjustments

- Green Finance

Each of these areas of potential policy and regulatory cooperation for APEC economies are deep subjects in their own right and each carries a voluminous literature. This study will adopt a literature review approach to yield summary conclusions and recommendations accessible to the broad and non-specialist policy and business community.

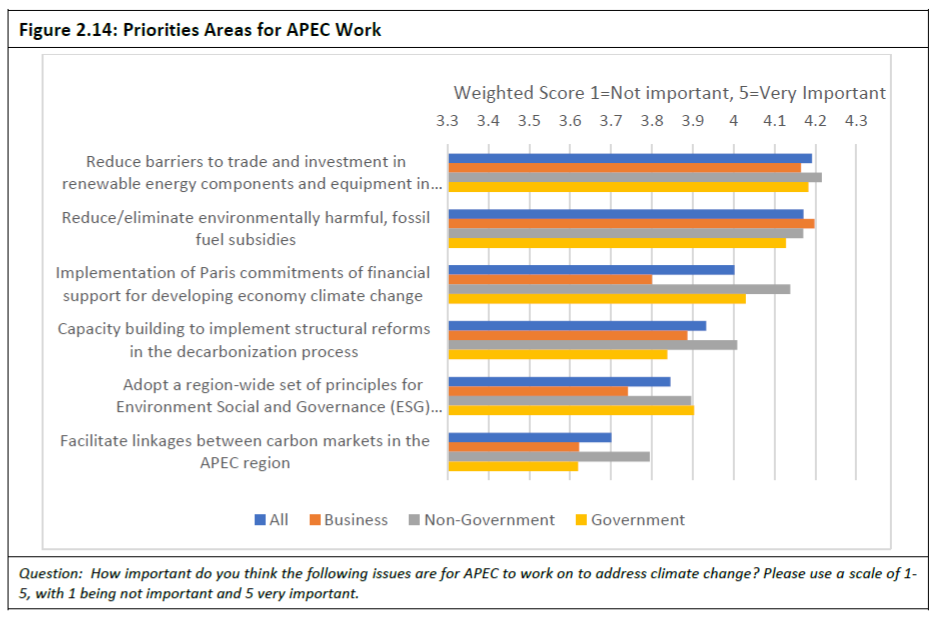

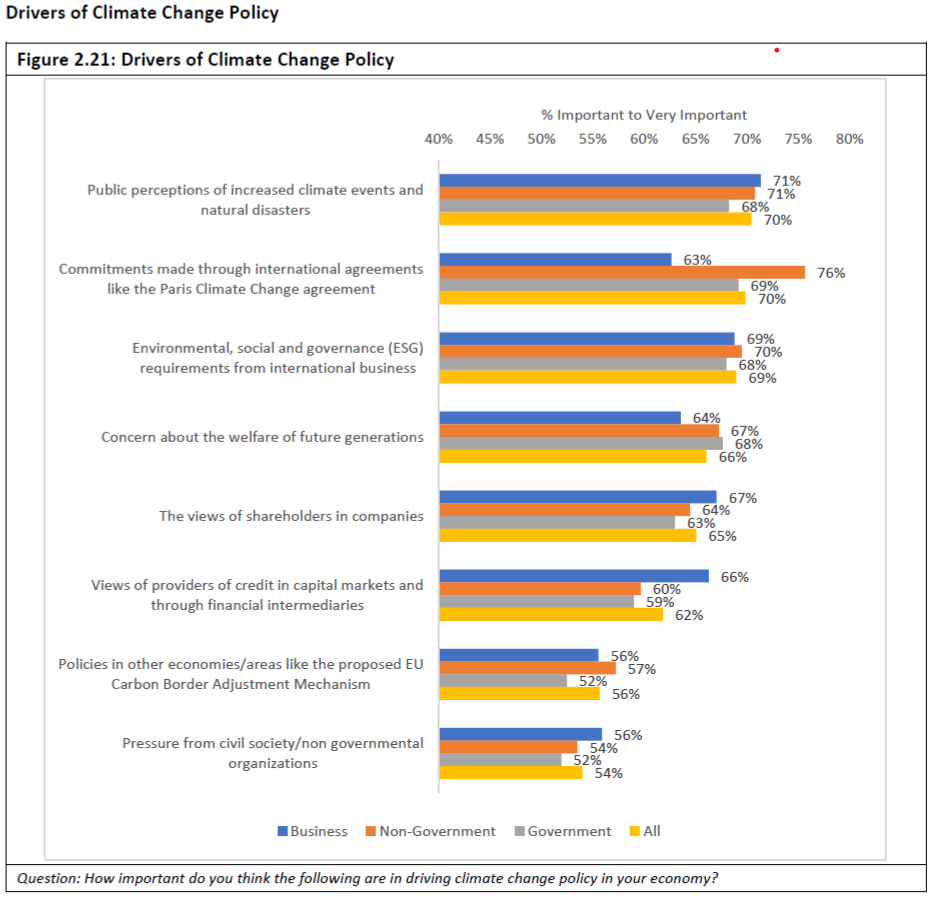

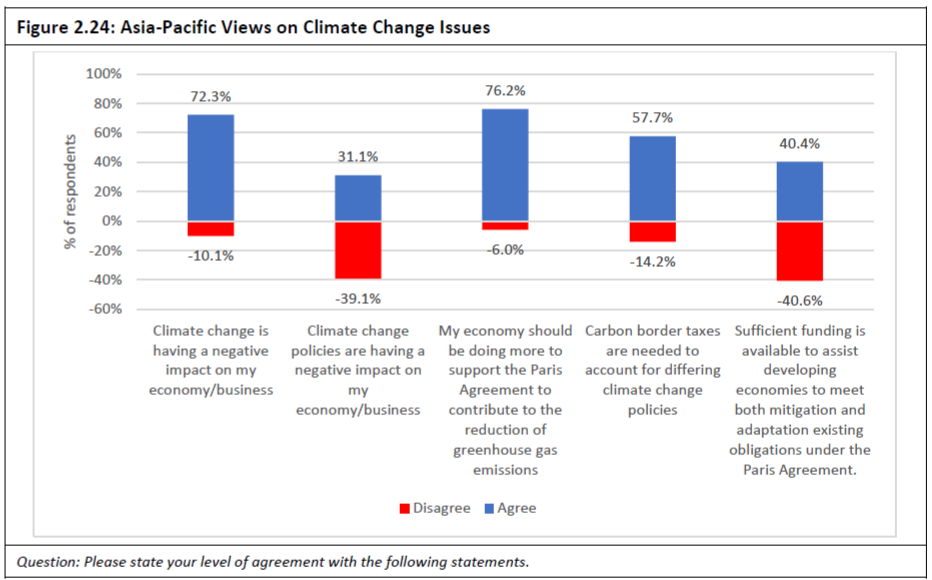

To complement the analytical work of this study, PECC undertook a survey of business, government, and non-government views on a range of climate change issues.

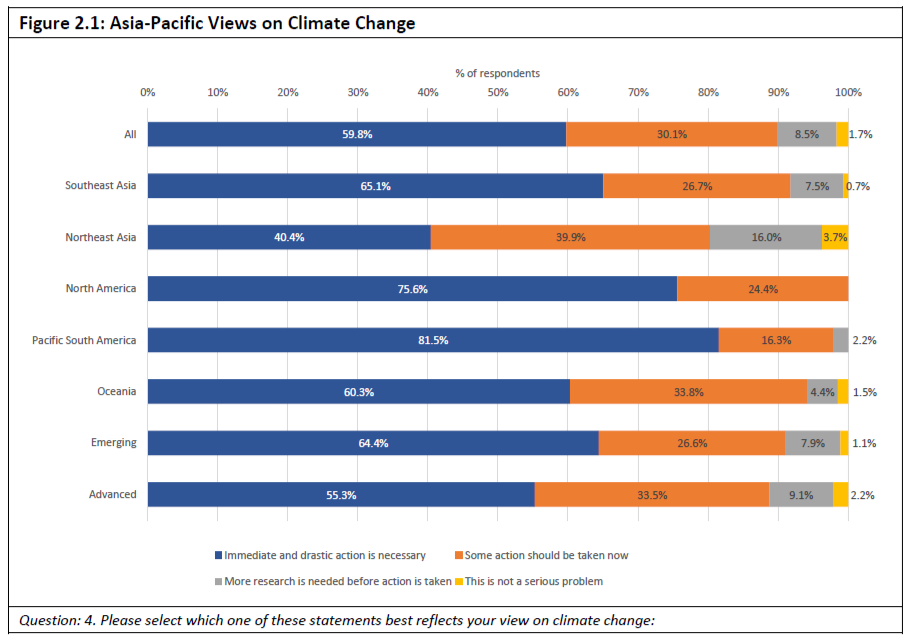

As is clear from the results shown in Figure 2.1, the view from across the region, with some variation, was that there is a strong expectation that ‘immediate and drastic action is necessary’ to address climate change.

Under the Paris Agreement, all parties are required to set GHG emissions reductions targets defined as nationally determined contributions (NDCs). Parties are expected to pledge increasingly ambitious NDCs every five years.

a. NDCs: varying ambitions among parties

The UNFCCC secretariat prepared a synthesis report on NDCs submitted by Parties and published on 17 September 2021.81 The report collated information from the 164 latest available NDCs, representing all 191 Parties to the Paris Agreement, including the 86 new or updated NDCs communicated by 113 Parties, recorded in the interim NDC registry as at 30 July 2021, covering 93.1 per cent of the total global emissions in 2019. The rest of this section of the report is based on the synthesis report unless referenced otherwise.

Almost all parties provided information on mitigation targets, in particular for 2025 and/or 2030. The mitigation targets range from economy-wide absolute emission reduction targets to strategies, plans and actions for low-emission development. According to the synthesis report “many Parties” strengthened their commitment to reducing or limiting GHG emissions by 2025 and/or 2030, demonstrating increased ambition to address climate change.82 More Parties than previously communicated absolute emission reduction targets, with some moving to economy-wide targets, resulting in most Parties having economy-wide NDCs. The Parties increased the coverage of sectors and types of GHGs. While new or updated NDCs increased the share of parties adopting absolute emission reduction or emission relative to “business as usual” (BAU) targets,83 those parties that adopted other means of reducing emissions included a range of policies and measures, emission intensity targets and target dates by which emissions should peak.

Many Parties included absolute emission reduction targets expressed as an emission reduction from the level in a specified base year, ranging from 13 to 88 per cent. A few other Parties specified a year or time frame in which their emissions are expected to peak or reach a maximum level of absolute emissions (e.g. by 2030).

Some Parties expressed their target as a carbon budget in addition to the absolute target, establishing an overall limit on GHGs to be emitted over a specified period of time (e.g. between 2021 and 2030). Some Parties included relative targets for reducing emissions below a ‘business as usual’ level by a specified target year, either for the whole economy or for specific sectors, ranging from 11.5 to 53.5 per cent. A few Parties had emission intensity targets for reducing specific GHG emissions per GDP unit relative to a base-year (e.g. 1990) level or listed other policies and measures to reduce emissions. Some Parties included two levels of emission reduction targets, with less ambitious ones being offered unconditionally and more ambitious targets conditional on the availability of international assistance in funding resources, technology transfer and capacity building.

Among all Parties NDCs, the most common emission reduction target (43%) was that expressed as a planned reduction from a projected “business as usual” outcome. Absolute emission reductions relative to a base or reference year or absolute quantified reductions without reference to any base year was the next most popular (35%). Just over a fifth of all NDCs chose other types of targets including reductions in emission intensity, target dates for planned peak emissions, and a range of other policies and measures or a combination of these.

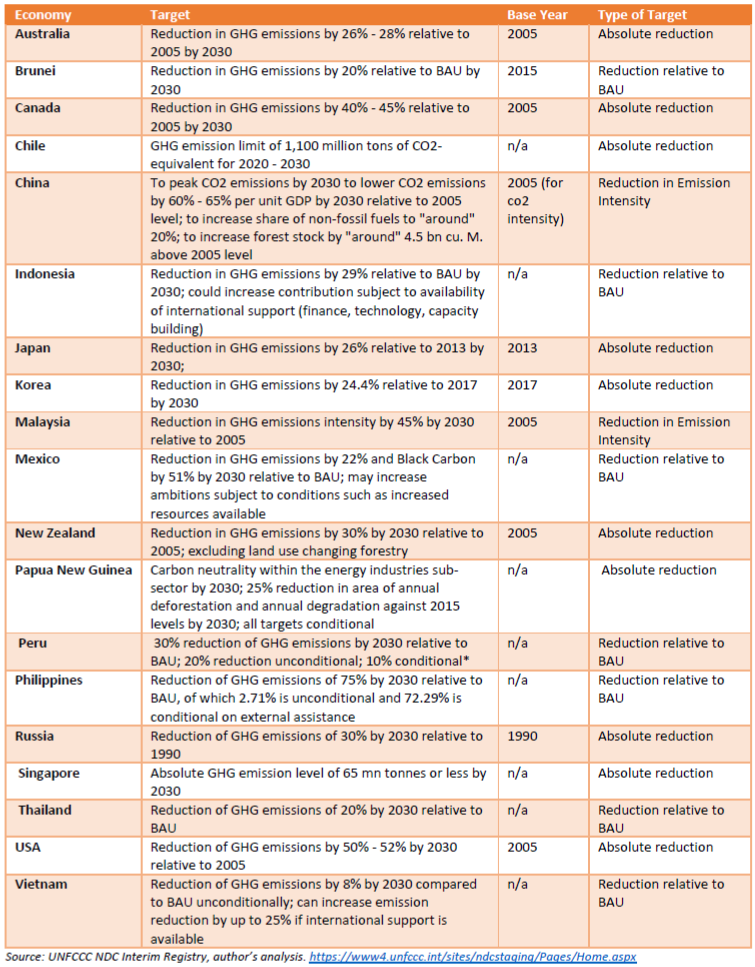

Table 2.1: Status of APEC NDCs and Targets

In Table 2.1, the APEC members NDC’s are listed with their main targets. Under the Biden administration which brought back the U.S. into the Paris Agreement (after President Trump’s previous decision for a US exit), the economy now is ranked as having one of most ambitious 2030 targets based on the change in absolute volumes of emissions by 2030. Canada and Japan are among the other economies in the region that have relatively ambitious targets in terms of planned emission reductions. In contrast, key developing economies – most notably India and China – can increase their emissions substantially to 2030, as their targets are related to emissions intensity per unit GDP. This intensity target allows for rising emissions by improving energy efficiency so as to continue economic growth, albeit with lower associated emissions.

Table 2.2: Total and Per Capita Emissions for Asia-Pacific Economies

Asia-Pacific economies account for approximately 69 percent of global emissions (a broad definition of the region including all APEC members, members of the East Asia Summit and PECC is used here). Measured on the basis of total emissions emerging economies with large populations tend to account for a larger share of global emissions, but measured on a per capita basis their annual emissions are significantly lower than advanced economies (see Table 2.2). The average global per capita emissions in 2019 was 4.7 metric tons, which is less than a third of the metric for the developed economies such as Australia, Canada and the US (in excess of 16 metric tons). Some of the lowest per capita emissions are in Asia among the large developing economies such as India (1.7 metric tons), Indonesia (2.3 metric tons) and Vietnam (2.6 metric tons) In negotiations on emission reduction commitments at COP26, the issue of per capita emissions and the role of equity and historical responsibility regarding past emissions will play a significant role for developing economies.

b. Comparing Emission Reduction Targets

Parties to the UN Convention have adopted different types of emission reduction targets for 2030 in their NDCs for COP26. As mentioned above, NDCs presented by Parties including absolute reductions of emissions from a base year, reductions from a hypothetical “business as usual” (BAU) trajectory over the 2020 – 2030 period or reductions in emissions intensity per unit of GDP and “other policies and measures”. This makes it inherently difficult to compare across various Party NDCs in terms of planned emission reductions compared to what would have happened in the absence of an emission reduction policy scenario. For example, the base year a Party chooses to compare its future target against can make a very significant impact on the Party’s proposed quantum of emission reductions.

Furthermore, the many assumptions involved in constructing a hypothetical BAU emission trajectory over the next decade or longer can be difficult to objectively verify as a fair representation of what can be expected given uncertain long run forecasts economic growth rates, development trajectories of low-emission technologies including renewable energy and electric vehicles and technological progress in energy efficiency performance across various economic sectors.

Promoting renewable energy generation were most frequently mentioned by Parties, followed by measures for energy efficiency improvement. Almost all Parties outlined mitigation targets in specific priority areas, such as energy supply, transport, buildings, industry, agriculture, land use, land use change and forestry (LULUCF) and waste.

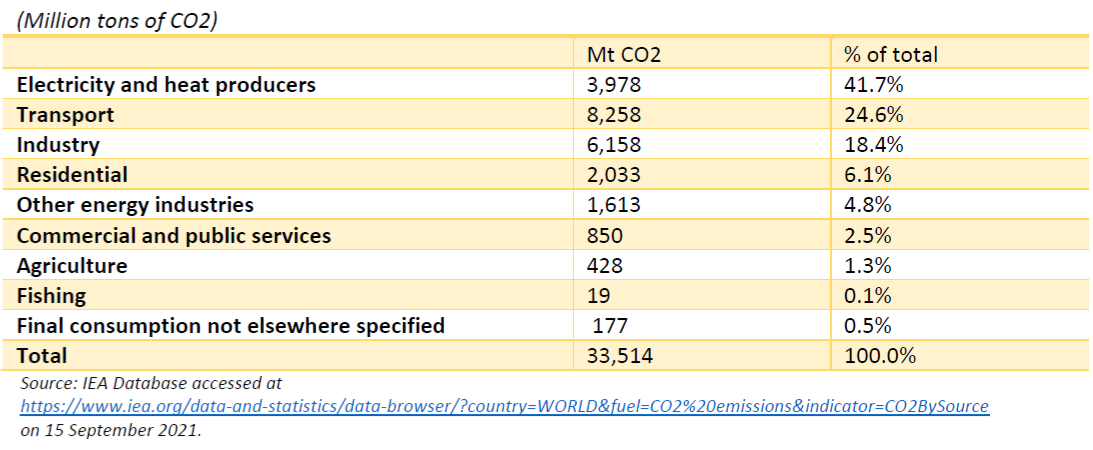

Global carbon emissions by sector are reported by the IEA in Table 2.3. Different economies will exhibit varying sectoral emission patterns as a function of their economic configurations. As can be seen, the electricity and heat generation sector is the most emissions-intensive, accounting for over 40% of total emissions. Transport is the next most important one, emitting almost a quarter of all emissions. Industry accounts for over 18%, followed by residential, other energy industries, and commercial and public services in that order. Agriculture and fisheries are minor emitting sectors.

Table 2.3: Global CO2 Emissions by Sector (2018)

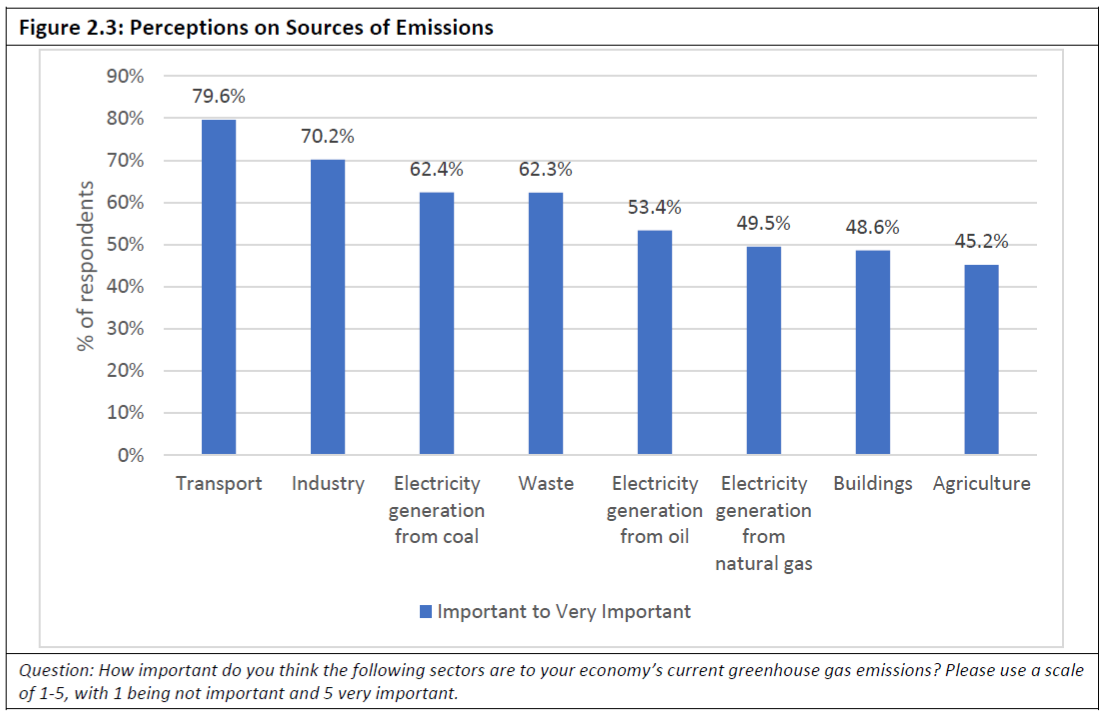

Perceptions of Emissions

Interestingly survey respondents saw transportation as the single most important sector of emissions followed by industry as shown in Figure 2.3. However, the three main current sources of electricity generation which are the single largest emitter were divided in the survey. The survey revealed important results about some disconnects between perceptions and actual emissions, for example, emissions from waste were seen as just as an important emitter as electricity generation from coal.

There were also considerable variations across sub-regions on the relative importance of different sources of emissions, for example 64 percent of respondents from Oceania had agriculture as an important source of emissions compared to 28 percent of Northeast Asians.

In general, most Parties indicated policy focus for emission reductions in the key sectors of electricity and heat generation, transport and industry which is broadly in line with the IEA data on sectoral emissions.84 Most NDCs indicated support for renewable sources, particularly for solar and wind technologies, in the electricity sector; promotion of electric vehicles in the road transport sector; and enhancement of energy efficiency across the industry, residential and other sectors.

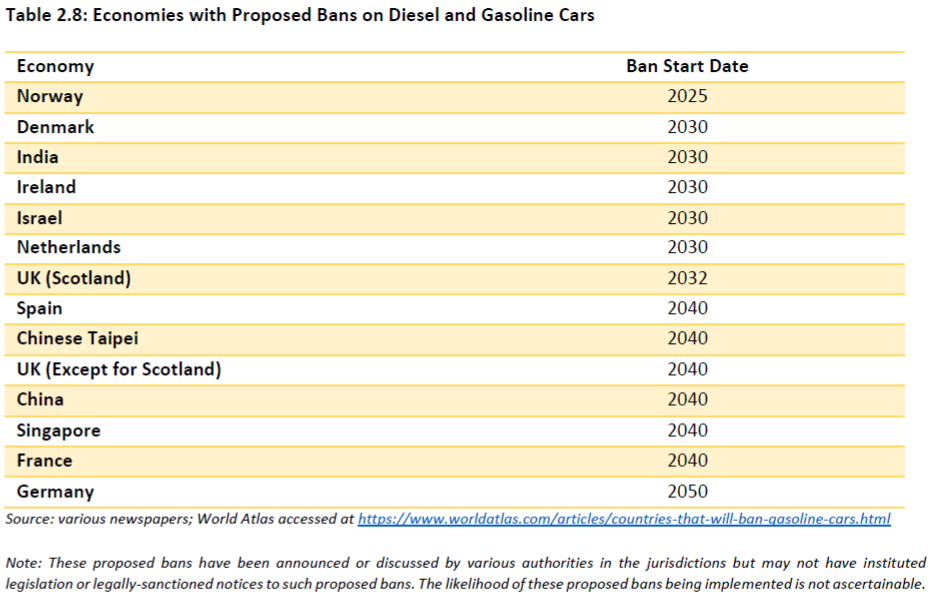

NDCs commonly identified markets and market-based incentives (MBIs) such as emission taxes or “cap-and-trade” of emission certificates as a means of efficient decarbonization by putting a price on emissions. Among MBIs mentioned in some NDCs, the reduction or complete halt of subsidies in the fossil fuels sector is also mentioned. A few Parties communicated specific discretionary measures, such as phasing out use of coal to produce electricity by 2025; banning new registration of internal combustion engine (diesel and gasoline) vehicles by 2030 or later (see discussion of electric vehicles in Section 1c); and requiring new buildings constructed to consume almost zero energy.

Most Parties where agriculture and forestry are important sectors identified domestic mitigation measures in the LULUCF sector, with some developing economy Parties referring to reducing deforestation (which include REDD+ activities)85 as a priority with high mitigation potential. In terms of measures for enhancing carbon sequestration in soil or vegetation, afforestation, reforestation and revegetation, sustainable forest management, and reduced deforestation and forest degradation were most frequently indicated. A few Parties communicated quantitative targets for increasing forest cover without competing for land in the agriculture sector. In addition to the medium-term focus (to 2025 and 2030) of most NDCs, many Parties provided information on long-term mitigation visions, strategies, or targets for up to and beyond 2050. Of those Parties, some reported targets of “net zero emissions” by 2050 or beyond.

In comparison with previous NDCs, there was an increased focus on adaptation planning. Adaptation priorities for most Parties, according to the NDCs, focus on food security and production; terrestrial and wetland ecosystems; human health; freshwater resources; key economic sectors and services; disaster risk management and early warning; human habitats and urban areas; coastal areas and sea level rise; ocean ecosystems; and livelihoods and poverty.

For APEC member economies which have significant agricultural sectors, both for export as well as domestic agricultural produce, there is broader momentum in creating missing markets in “natural capital” that is relevant to both the adaptation and mitigation streams of climate change action. The rate of build-up of CO2 in the atmosphere can be reduced by taking advantage of the fact that atmospheric CO2 can accumulate as carbon in vegetation and soils in terrestrial ecosystems. Under the UNFCCC any process, activity or mechanism which removes a greenhouse gas from the atmosphere is referred to as a "sink". Human activities impact terrestrial sinks, through land use, land-use change and forestry (LULUCF) activities.86

Land management via LULUCF activities can improve both environmental and economic outcomes of the agricultural sector. Increasing diverse plant and tree shelters on land, for example, can support and protect biodiversity and improve the quality of the soil and crops and cattle. Limiting the access of cattle to rivers and pumping water for cattle to water stations, for example, can support recovery of river ecology and biodiversity, improve soils and reduce parasites in cattle.

There are three steps to creating markets from better land and water management:

- clear and accurate measurement, reporting and verification (MRV) processes of environment and economic outcomes – there have been a remarkable advances in the application of digital, spatial and remote sensing technology which can be brought to bear

- the verifiable measurement of economic outcomes means that risk can be accurately measured and used to price financial instruments, like loans, bonds and equity. Governments can assist in scaling up sustainable farm loans, aggregating and securitizing such loans as collateralized debt obligations.

- identifying the role of government – three aspects are important: governance assuring the quality of environmental and economic data measurement and verification; proof of concept; and extending the maturity profile of loans and finance since some of the economic payoffs can take years to grow (e.g. lifting diverse tree cover on land as a short term cost as land is taken out of use and the benefits to soil, grass and crops takes five years or more to occur). There may be a role for a natural capital finance corporation to spur markets in natural capital and what form it should take.

The benefits of creating markets in agriculture or an economy’s “natural capital” are significant if existing agricultural markets are incomplete or absent. It improves environmental and economic outcomes in the agricultural sector with co-benefits in both mitigation and adaptation efforts. It increases the resilience of agricultural assets such as forests and farms in the face of damaging climate change (i.e. adaptation), It supports carbon abatement through LULUCF activity, and can create a source of income through carbon credits (i.e. mitigation). It provides a way for farmers to show consumers that their products are “sustainable”. Hence this would sustain domestic and international markets in agriculture. It sustains lending to agriculture by reducing risk to that sector.

This is an issue that affects all economies and is a natural area to work on with others, including those with whom relations are under pressure. There is cooperative work in Australia, China and the United States, and it is appropriate for on-going policy agendas in forums like APEC and G20. If it can be shown that the risk associated with sustainable natural capital is measurable and lower than otherwise, it should be reflected in the international rules for risk in finance, such as the Bank for International Settlements rules for banks and those for securities. (The role of central banks in assessing climate change risk and regulating reporting standards by private firms across all sectors, agriculture and industry, is discussed further in sections 4e).

There was also a greater emphasis in some NDCs on the mitigation co-benefits of adaptation action plans. Adaptation actions with mitigation co-benefits include climate-resilient agriculture, reducing food waste, vertical farming, enhancing coastal ecosystems and moving to the “circular economy” for better waste management. Urban infrastructure management to improve drainage and mitigate flooding are some of the other examples of adaptation planning that would produce co-benefits for mitigating emissions. Among other adaptation measures with co-benefits for emission mitigation mentioned in some of the NDCs is carbon dioxide capture and storage.

While the NDCs indicate priorities of various Parties in mitigation and adaptation activities, what has been the evidence to date regarding actual spending on various sectors? Data gathered by the Climate Policy Initiative (CPI), a climate policy thinktank, offers estimates of global spending on climate change initiatives in its “Global Landscape of Climate Finance” annual reports. According to data gathered by CPI, the public sector constituted between 39% and 46% of total spending, the rest by accounted for by the private sector.87

The most striking feature of expenditure on climate initiatives is the overwhelming amount spent on just two renewable technologies -- solar and wind energy – accounting for 55% of all spending during 2011 – 2018 shown in Figure 2.4. If spending on “other renewables” (biomass and waste, biofuels, hydroelectricity, “others”) is included, then spending on renewables accounts for 65%. The other striking feature of the spending pattern is that climate adaptation only accounts for 5% of total climate-related expenditure.

In emphasizing climate mitigation over climate adaptation to reduce the impacts of future climate change on human welfare, the implicit assumption is that greenhouse gases are the primary driver of climate change and trying to “fight climate change” by reducing greenhouse gas emissions is the overriding priority.88

The second approach, climate adaptation, involves developing better infrastructure for dealing with climate change and extreme weather, as has been done throughout human history (eg. by building dykes or levees to handle flooding, weatherizing houses to handle hurricanes or tropical storms, upgrading urban drainage systems, etc.). By overemphasizing climate mitigation efforts, the UNFCCC and COP agreements such as the Kyoto Protocol and the Paris Agreement may have led to a bias against investment in climate adaptation.89

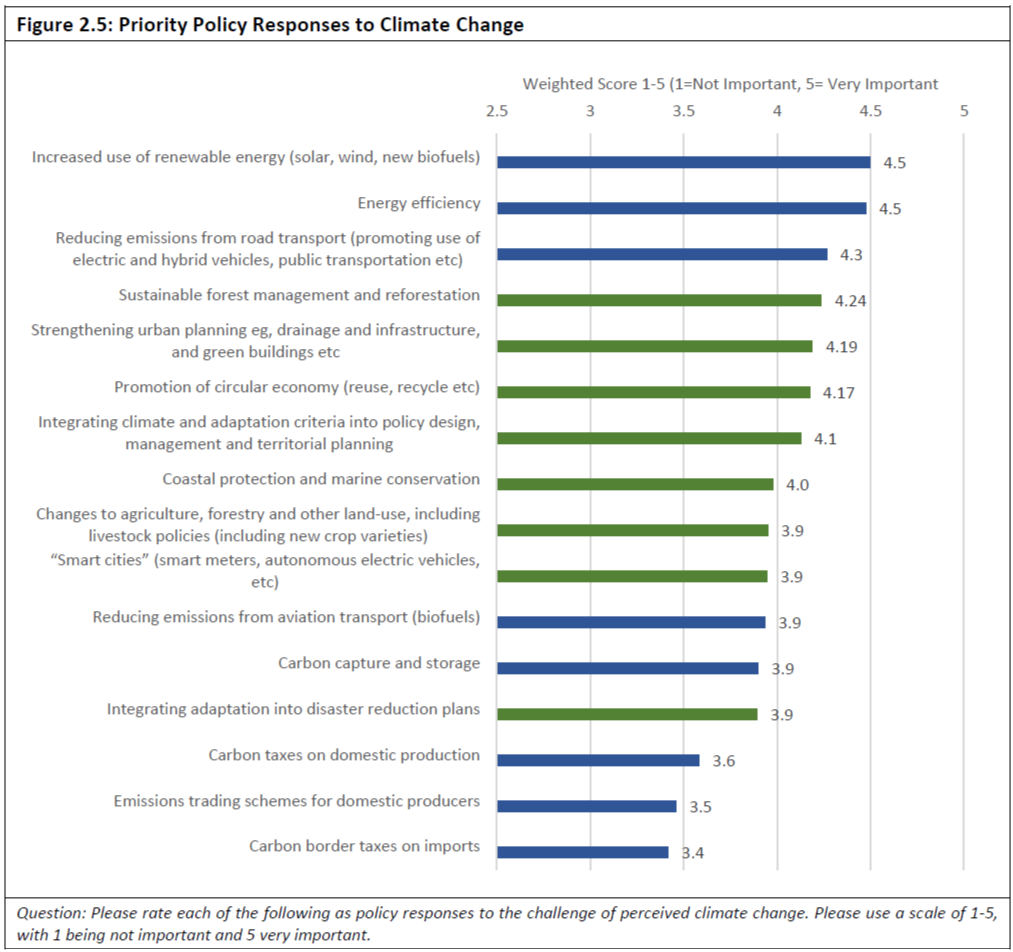

According to PECC’s survey, while stakeholders put highest importance on emission reducing measures, adaptation measures closely follow behind (Figure 2.5). The Asia-Pacific view is that:

- There is an equal need to promote the greater use of renewable energies as well as energy efficiency

- The next highest priority is to reduce emissions from road transport

- These are followed by a series of adaptation measures of almost equal importance: sustainable forest management; strengthening urban planning; and promoting the circular economy (reuse, recycle, etc.)

Interestingly, market-based schemes like emissions trading and carbon taxes came far down the list of priorities. This was an important finding given the trends around the world and statements from key institutions on the need for setting a carbon price. There is clearly a gap that needs to be filled.

At the sub-regional level there were no significant differences in priorities. There were some minor differences likely based on relative importance of sectors to economies, for example, “Changes to agriculture, forestry and other land-use, including livestock policies (including new crop varieties)” was rated a relatively more important policy by respondents from Oceania and Pacific South America compared to respondents from Northeast Asia.

c. Assessing the Potential for Achieving NDCs among APEC member economies

It is important to clarify just what is meant by “low carbon energy transitions” prior to looking at how APEC member economies, individually and collectively, can participate in such transitions.90 A clear distinction that is to be made between what is theoretically or technically possible and what is economically feasible. In assessing the performance to date and the further potential of APEC member economies for achieving communicated NDCs, we first provide an introduction to the nature of energy transitions in a long-term perspective. Set in this context, we follow with brief overviews on renewable energy in the power generation sector, electrification in the transport sector, energy efficiency enhancement across sectors, carbon capture and storage, and hydrogen to replace fossil fuels in heating, power, industry, and transport

i. The Nature of Energy Transitions

The shift in dependence among fossil fuels over the past two centuries was marked by the prolonged and gradual nature of energy fuel transitions. From the almost complete dependence on traditional biomass (wood, charcoal, dung, straw) prior to 1800, it took coal a century to account for half of primary global energy consumption. And it took oil about 70 years from its infancy and early use in 1900 before it accounted for about a third of global energy consumption.

Currently, we live in a “fossil-fuel civilization”, as Vaclav Smil terms it.91 After decades of government mandates and hundreds of billions of dollars in subsidies primarily in Western Europe and North America, renewable energy (RE) technologies such as solar, wind, geothermal and new biomass fuels (such as biodiesel and ethanol) account for just 5.7% of global primary energy consumption. Even for the OECD members, where renewable energy has grown the most, fossil fuels still provide an average 78% of their energy needs.

There is little evidence of an accelerating energy transition at a global scale despite the rapid growth rates of the renewable energy. Given the small existing contributions of these newer technologies and their very low-capacity utilization factors, rapid growth rates in RE capacity make relatively small contributions to the overall distribution of global fuel sources of primary energy expended.

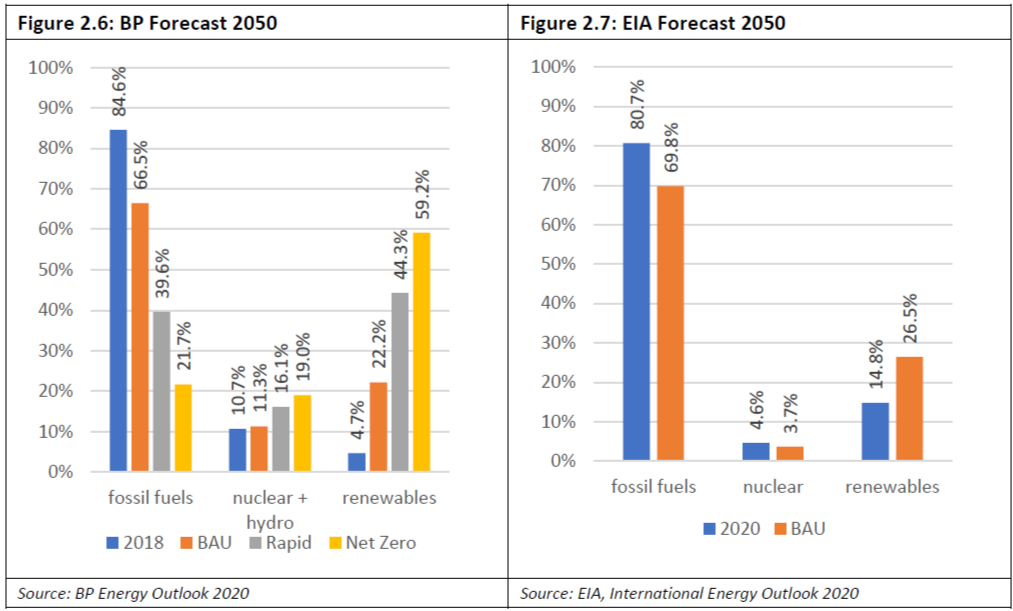

It is instructive to compare two well-known long-run energy forecasts, one by BP and the other by the US Energy Information Administration (EIA) for 2050, using 2018 data as baseline.92 The US EIA reference forecast assumes that current laws and regulations are implemented, while the BP forecast offers 3 scenarios, “business-as-usual” (BAU), “rapid” and “net zero by 2050”.

The EIA reference forecast is comparable to BP’s BAU scenario. It should be noted that the EIA includes hydro-power in the renewables category while BP includes it in its “nuclear and hydro” category (it excludes hydro from its renewables category). Furthermore, the EIA includes new biofuels such as ethanol and biodiesel in its liquid fuels category. Nevertheless, given the relative small and slow growing shares of hydro and biofuels in total primary energy, the two forecasts are broadly comparable.

BP’s “BAU” scenario is roughly similar to EIA’s reference case with respect to the share of fossil fuels into total primary energy consumption in 2050. BP shows fossil fuels contributing 66.5% while the EIA shows a somewhat higher contribution of 69.8% by 2050 compared to over 80% in 2018.93 What is remarkable are BP’s very aggressive “rapid” and “net zero (by 2050)” scenarios, which show fossil fuels being reduced to less than 40% of total energy consumption in 2050 under the Rapid scenario and just 20% in its Net Zero scenario.94 The EIA sees renewables (including hydro) contribution increase to 26.5% by 2050 from 14.8% in 2020 in its reference scenario. BP, in its BAU scenario sees renewables (excluding hydro) grow from 4.7% in 2018 to 22.2% in 2050. What is far more remarkable is BP’s projected share of renewables in 2050, ranging from 44.3% in the Rapid scenario to almost 60% in its Net Zero scenario.

The underlying differences in the long run outlook between BP and the EIA are made more apparent by looking at the compound annual growth rates of primary energy sources over 2018 - 2050. Unlike EIA’s projection of a total primary energy demand compound annual growth of 1.3%, BP’s projects significantly lower growth in all its scenarios. In its BAU scenario, total primary energy demand grows only by 0.7% each year compounded. In its rapid and net zero scenarios, this growth is more than halved, with total energy demand growing only by 0.3%.

The contrast between the two forecasts is even more dramatic when projections of fossil fuels use is considered. The EIA projects a growth of 0.8%, while BP forecasts zero or negative growth in its scenarios. In BP’s BAU scenario, there is no growth in fossil fuel use during the period, while it falls by 2.1% every year in the Rapid scenario and even more dramatically by 3.9% in its Net Zero scenario.

In sum, BP forecasts for renewable energy are far more optimistic, growing by 5.7% annually in its BAU scenario, in contrast to the EIA’s 3.3%. BP is much more optimistic in its Rapid and Net Zero forecasts, where renewables grown by 7.5% and 8.5% respectively. The projections over 30 years magnify the results exponentially when compounded over 30 years.

The extensive coverage in the media regarding the rapid growth in renewable energy, primarily wind and solar power, lacks sufficient attention to the far more consequential realities in the evolution of global energy use.95 The continued dominance of fossil fuels and of the role of developing economies – which account for more than 80 per cent of the global population – in the growth of energy demand is a major determinant in the outlook for “decarbonization”. If by “energy transition” is meant the replacement of a class of fuels by another (as shown in the work of Vaclav Smil discussed above), then the EIA forecast does not see any such transition by 2050 but expects a continued and important role for coal, liquid fuels, and natural gas into the middle of this century.

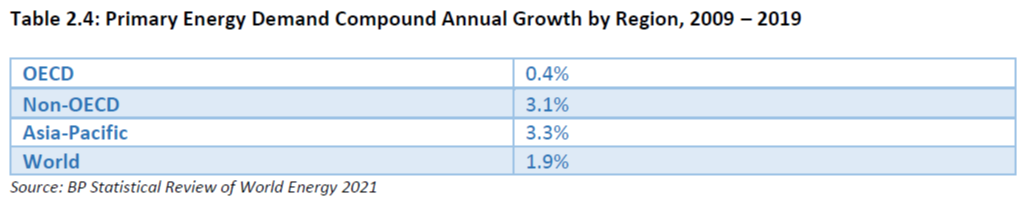

In the decade before the covid pandemic demand shock in energy in 2020 (i.e. 2009 – 2019), while OECD demand for total primary energy grew by 0.4%, non-OECD demand grew by nearly 8 times as fast, by 3.1%. Asia-Pacific primary energy demand grew even faster at 3.3%. World demand grew by 1.9%.

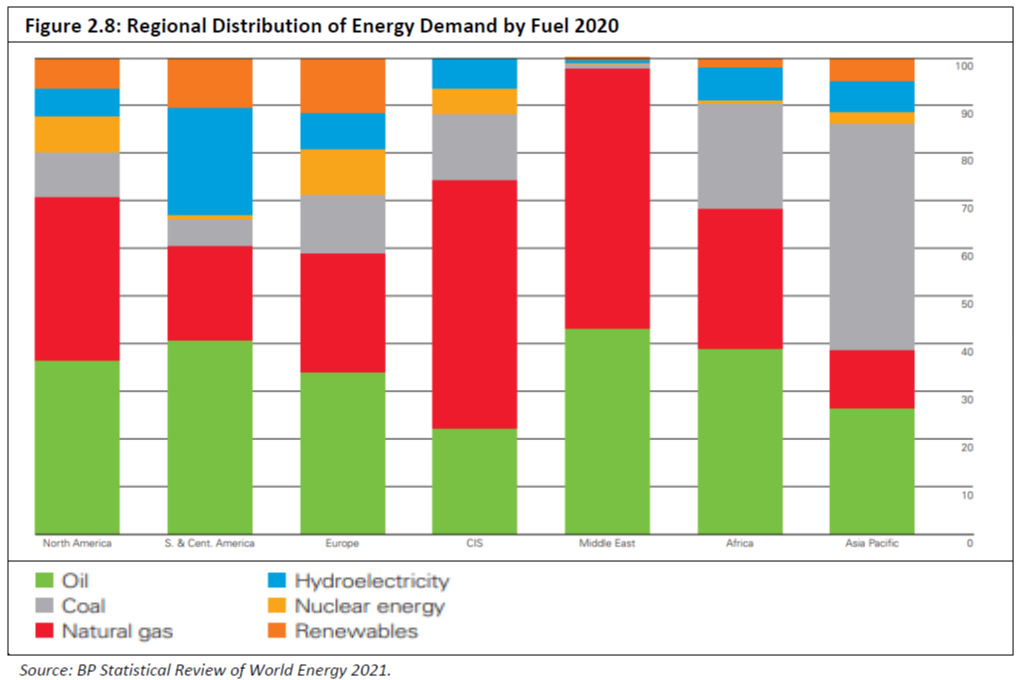

While fossil fuels dominate the energy mix, developing economies, in particular those in Asia, increasingly determine the geographical distribution of energy use. Developing economies accounted for 61% of global energy demand in 2020. The importance of coal to developing economies in Asia is stark (see Figure 2.8 below). Almost 82% of global coal consumption occurred in the developing world and developing Asia accounted for almost all of it.

The dominating role of the developing economies in energy demand growth is better illustrated in incremental terms. In the five years to 2019, developing economies accounted for 88% of global incremental demand for primary energy and OECD for the remaining 12%. The Asia-Pacific region alone accounted for almost three quarters of global incremental demand during 2014-2019.

In assessing the opportunities to de-carbonize on a global scale, in order to meet the goals consistent with the Paris Agreement, the immense scale of the current fossil fuel-based global energy system needs to be kept in mind. It cannot be emphasized enough that attempting to displace the vast existing global infrastructure that constitutes the current global energy system with a mix of intermittent power generation technologies (such as solar and wind power) and liquid biofuels will be a prolonged and gradual process for generations to come, going well past the middle of the current century.

In order to develop a strategy to mitigate global energy use-related GHG emissions, it is critical that the scope of the challenge is well defined and clearly understood. Most analysis of global energy systems recognize the importance of a portfolio of electricity generation technologies including a significant portion of which must be “dispatchable”, i.e. available at any time needed by a changing demand load on the electricity grid. Intermittent renewable energy technologies such as wind and solar can only provide power as a function of solar insolation and wind speed which are contingent on local conditions such as time of day, cloud cover and varying wind speeds.

Just how credible is the call for a complete transformation of the global energy system within three decades which today relies on fossil fuels for 85% of its needs? In relation to low-carbon energy transitions, a clear distinction is to be made between what is theoretically possible and what is economically feasible. An objective study of the costs and benefits of decarbonization proposals needs to minimally show at least the following properties:

- Transparent data inputs, plausible assumptions and validated, replicable modelling;

- Technology assumptions that are proven at scale at a cost comparable with existing alternatives;

- Deployment rate assumptions that are plausible in comparison to historical examples of decarbonization in the energy sector; and.

- Incorporation of the social and economic costs of existing environmental and permitting process constraints.

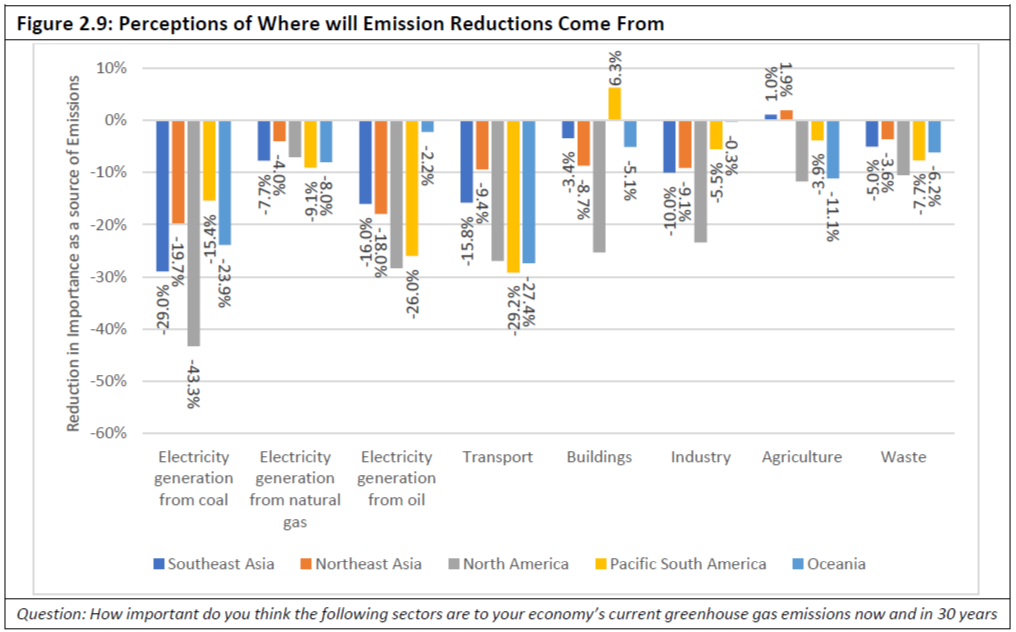

Respondents to PECC’s survey were asked to rate the most important sources of emissions to their economies both today as well as in 30 years’ time.

Figure 2.9 shows the fall in the percentage of respondents who thought the sector was an important or very important source of emissions over the next 30 years. As seen in the chart, there was substantial variation across the region on where reductions in emissions will come from. By far, emissions from electricity generation from coal had the largest drop in importance across all sub-regions, although there was some considerable variation. For North Americans it was much larger a drop of 43 percent, while for Pacific South Americans it was a drop of 15 percent.

Emissions from the electricity generation from natural gas, largely seen as a ‘transition’ fuel still saw a drop in importance but less so amongst the traditional fossil fuels.

Interestingly, some sub-regions saw emissions increasing from certain sectors. For example, respondents from Pacific South America expect emissions from buildings to increase, while respondents from Northeast and Southeast Asia expect emissions from agriculture to increase.

ii. Renewable Energy in the Power Generation Sector of APEC Member Economies

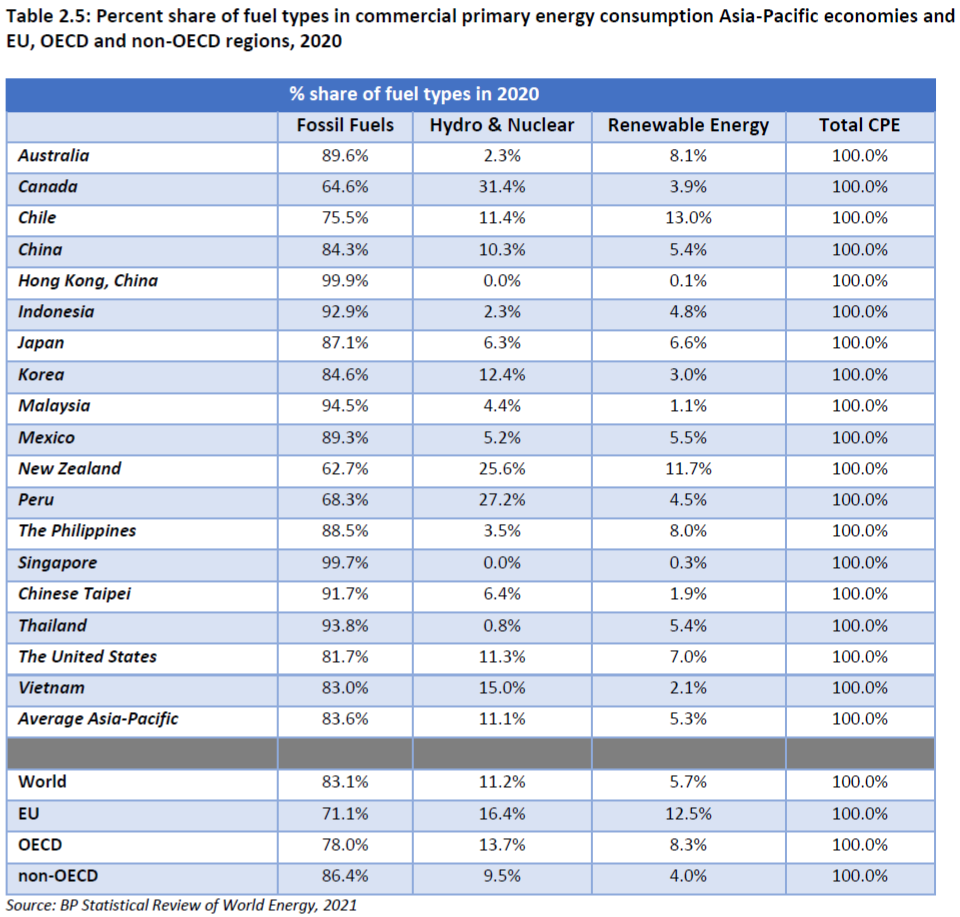

The pattern for the distribution of commercial primary energy (CPE) consumption by the categories defined in Table 2.5 for the Asia-Pacific regional average is similar to the world pattern. Within the Asia-Pacific, most economies depend more on fossil fuels as a share of total primary energy consumption relative to the world average of just over 83%. Among the exceptions are Canada, Chile, New Zealand, and Peru, all of which are well endowed with hydropower resources. Those that have renewable energy share of total CPE which exceeds the world average are Australia, Chile, New Zealand, the Philippines (mainly geothermal) and the US.

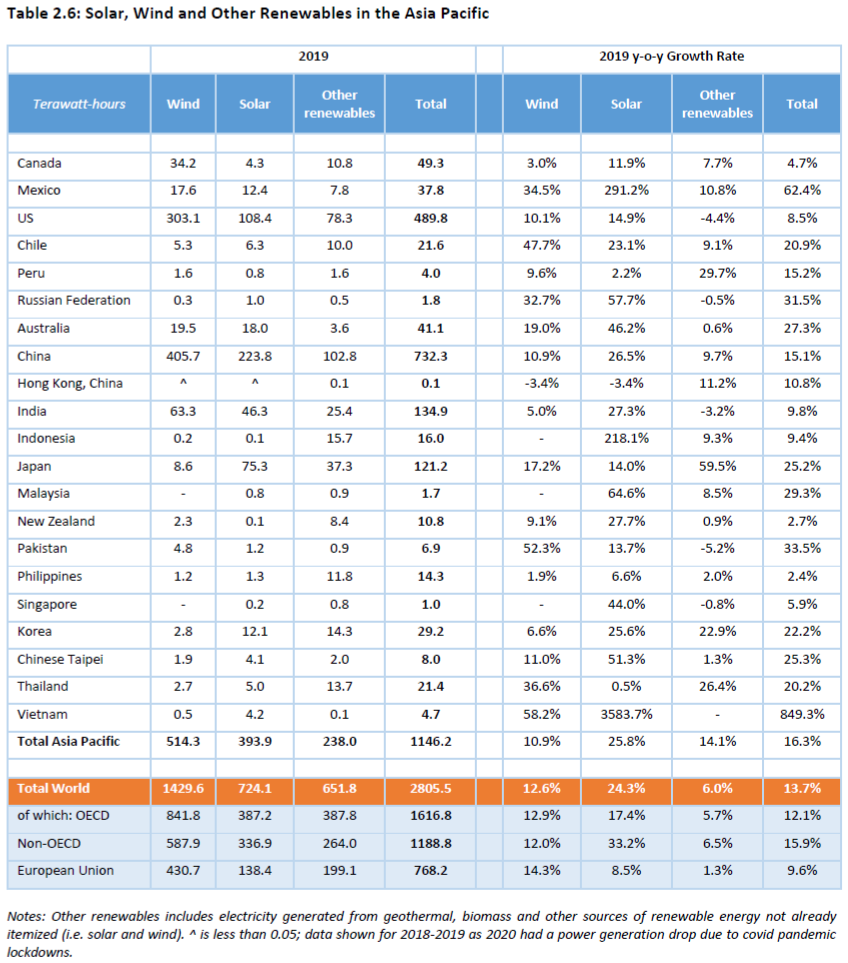

Table 2.6 below provides data for 2019 which breaks down renewable energy generation by source among wind, solar and “other” (which includes geothermal, modern biomass fuels such as biodiesel and ethanol and other sources not itemized). At the global level, wind power generation (1,429.6 terawatt hours or twh) was about twice that of solar power generation (724.1 twh) in 2019. Wind power’s dominance over solar is also the case in most economies in the sample of regional economies in Table 2.6. The exceptions are Chile and many Asian economies which lack wind energy resources (Japan, Malaysia, the Philippines, Singapore, Korea, Chinese Taipei, Thailand and Vietnam). The growth of solar power globally was more than double that of wind in 2019 over the previous year.

Some economies exhibited extremely high rates of growth in 2019 over the previous year in both wind and solar power generation due to the small base in 2018. Mexico, Chile, Australia, Japan, Malaysia, Korea, Chinese Taipei and Thailand experienced growth in renewable energy generation in 2019 significantly above the global growth rate of 13.7%. This reflected the very small base this growth rate is calculated from. For example, Vietnam’s remarkable 849.3% growth shows its renewable energy generation increased from 0.5 twh in 2018 to 4.7 twh in 2019. So, by looking at 2019 growth rates in renewable power generation, one might be encouraged at the rapid rates of growth in Asia-Pacific and among most APEC members economies.

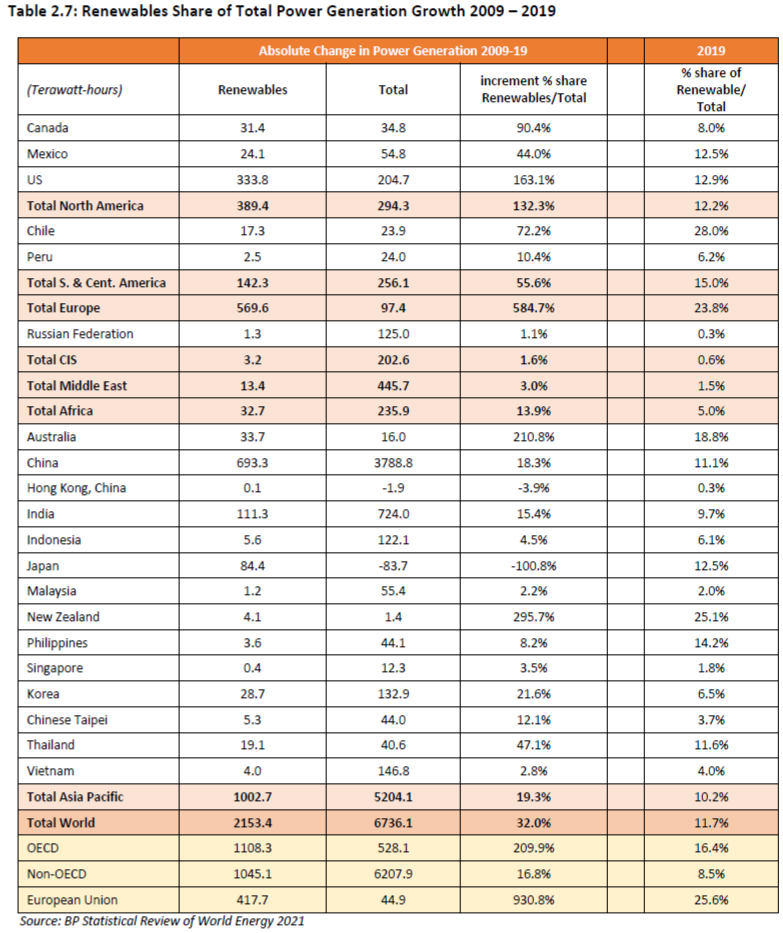

In assessing the performance of APEC member economies in expanding the role of renewable energy, it is important to note not only the small role of renewable energy in total CPE (Table 2.6) and its rapid annual growth in 2019, typically from a small base. It is more informative to assess the growth of renewable energy in incremental terms: that is, what is the growth of renewable power generation in proportion to the growth of total power generation over a longer period? Table 2.7 gives the data for the global total as well as for the non-OECD, OECD and Asia Pacific regions for the decade 2009 - 2019. The percent share of increase in renewable power generation in total power generation during 2009 – 2019 is far higher in the developed APEC member economies and other OECD economies than the developing economies. By region, North America, Europe, EU as well as well as OECD members far higher renewable shares in incremental power generation during the period. The ratios for these regions, respectively, are 132%, 585%, 931% and 210%. These ratios are far in excess of the global average of 32%.

This reflects not only the substantial increase in renewable energy generation but also the very slow growth in total power generation (the denominator) during the period. These ratios are also much in excess of the (static) share of renewable energy in total power generation in 2019, hence showing the progressive growth over time that these regions can expect in replacing fossil fuels although how long it will take to completely replace fossil fuels is subject to many factors including the fact that the intermittent nature of renewable technologies and the lack of scalable storage of grid power mean that increase in renewable energy capacity will require back-up dispatchable power (such as natural gas). When the wind does not blow or the sun does not shine, back-up dispatchable power will be necessary to power the grid.

In the Asia Pacific, renewable energy accounted for 19% of the increase in total power generation during 2009 – 2019. Given the very low (static) share of renewable power in total power generation in 2019 (10%), the rate of increase in renewable energy will progressively increase the share of renewables in power generation but very slowly. In other words, 81% of the region’s increase in power generation during 2009 – 2019 was met by either fossil fuels (coal, oil and natural gas) or nuclear and hydropower. This was just a little less than the 83.6% share that fossil fuels accounted for in Asia Pacific’s primary energy consumption in 2020 (see Table 2.5). That is to say, despite the high percentage increase in renewable power generation, the increase in the use of fossil fuels for power generation in Asia Pacific during the decade 2009 – 2019 accounted for almost as much in incremental demand as their share in total primary demand in 2020. This holds for developing economies, as well as other regions such as the Middle East, Africa, and the CIS states (which includes Russia). In the Asia Pacific, Hong Kong (China) and Japan were exceptional in recording a fall in total power generation during the decade.

In summary, it is apparent that the advanced economies have had relatively rapid growth in renewable energy as a share of total power generation, although the rate of progress shown in the decade 2009 – 2019 may not necessarily hold out in the long run future. Intermittency of renewable generation have a significant impact on electric grid reliability, costs of system operations, and requirements for backup generation capacity. Not only are there technical issues related to the intermittency and low power density of renewable energy and the exorbitant cost of power storage at grid or utility scale,96 but the increasing costs of renewable energy subsidies to consumers and taxpayers have been noted particularly in the EU,97 UK98 and states such California99 and South Australia100 which have been leaders in subsidizing the growth of wind and solar power. The costs of intermittency, low power density and large-scale battery storage together with the continued subsidy support that governments need to provide in order to support the growth of renewable energy capacity are considerable and challenging even for the much richer developed economies.

The rate of growth of renewable power generation in the developing economies of Asia Pacific primarily reflect the small base on which these growth rates are calculated. Given the rapid historical increase in power consumption in these economies, most credible forecasts show continued rapid growth in power consumption most of which will be supplied by fossil fuels. It is important to note that renewable energy is still mostly used to generate electricity, and electricity as a share of global final energy consumption is still just 18%. The direct use of fossil fuels is still the primary energy provider for modern economies across the world. Particularly for the developing economies, renewable energy will play a relatively marginal role in meeting rapidly growing needs for grid electricity for decades to come. Meeting the economic development and poverty alleviation objectives of these economies -- where per capita electricity consumption rates are low and universal access to grid electricity is still lacking -- are policy priorities that are not likely to be compromised at the negotiations at COP26.

iii. Energy Efficiency across Sectors

iii. Energy Efficiency across Sectors

Energy efficiency improvements have long been held by its proponents as a means of attaining multiple policy objectives – it can help net-energy importing economies in the balance of payments account, reduce costs for households and firms, enhance national security and improve environmental outcomes. Given the widespread policy emphasis on energy efficiency, there is a clear need to assess how well such policies have fared in practice. In this section, “energy efficiency policies” refers to policies such as subsidies, standards, and labeling and information provision that attempt to directly encourage energy efficient investments but do not directly affect energy prices. Policies that adopt market-based incentives (MBIs) such as carbon taxes and cap-and-trade schemes are discussed separately in the section on carbon markets below

The discussion of energy efficiency in this section looks briefly at the background to the widespread adoption of energy efficiency policies around the world, followed by more examples of energy efficiency policies in the Asia-Pacific region. Energy efficiency policies that have been implemented are discussed next, followed by a critical evaluation the effectiveness of energy efficiency policies which include discretionary financial incentives, mandated technology and performance-based standards, and labeling and information programs. Finally, this section concludes with recommendations on how energy efficiency policymaking can be improved.

Status of energy efficiency efforts in the Asia Pacific region

Improved energy efficiency refers to the reduction in energy consumed in delivering a given level of energy service (heating, lighting, locomotion, etc.).101 Most economies typical set economy-wide targets in terms of energy intensity ratios. As we have already noted, energy intensity targets are a major component of NDCs. One reason for adopting the energy intensity metric is simply the ease with which these measures can be computed and interpreted.

Over the past two decades, the mounting concerns over global climate change have made the emission mitigation potential of energy efficiency investments a declared core benefit for many policy makers. The IEA predicts that the reduction in global CO2 emissions needed to achieve the Paris Agreement goals and “net zero by 2050” in the longer term depend critically on energy efficiency measures as a key pillar.102 It is therefore of no surprise that energy efficiency policies form an increasingly critical dimension to most economies’ overall economic growth agendas.

Most APEC member economies have adopted economy-wide energy efficiency targets. APEC member economies aim to achieve a reduction of 45% in energy intensity for the group by 2035 from the base year in 2005.103 According to APERC data, energy intensity in the APEC region declined by just over 22% between 2005 – 2017, or as stated in the report, “49% of the way to the goal in 40% of the time”.104

At the aggregate economy-wide level, measures of energy intensity, expressed as the unit amount of energy used (in BTUs or kilograms or tonnes of oil equivalent) to produce a unit of GDP, are often the most-widely used metric to assess trends in energy use over time and across economies. While energy intensity has been declining over recent decades, the IEA states that it needs to improve by 4.2% per annum over 2020 – 2030 in order to achieve its sustainable development scenario which meets the goals of the Paris Agreement, and in the longer run, the “net zero by 2050” scenario.105 The IEA target of 4.2% per annum is over 2.5 times the rate exhibited over the previous decade.

Two broad patterns can be discerned in the way in which energy intensity has evolved since 2000: higher income economies tend to have lower energy intensity levels, and energy intensity levels have fallen across the last 2 decades in most of the economies in the sample with the exceptions of rapidly industrializing middle and lower income economies of Malaysia, Thailand, and Vietnam. Among the OECD economies, Australia, Canada, and the US show progressive declines in the ratio over the period. As major natural resource producers, Australia and Canada are at higher absolute levels than resource-poor Japan but lower than Korea. The US has levels of energy intensity that lie somewhere between Australia and Canada, and somewhat higher levels than the OECD average. Japan has the lowest intensity ratios among the OECD group although, given low or negligible economic growth rates over the past 2 decades, its rate of energy intensity improvement is muted.

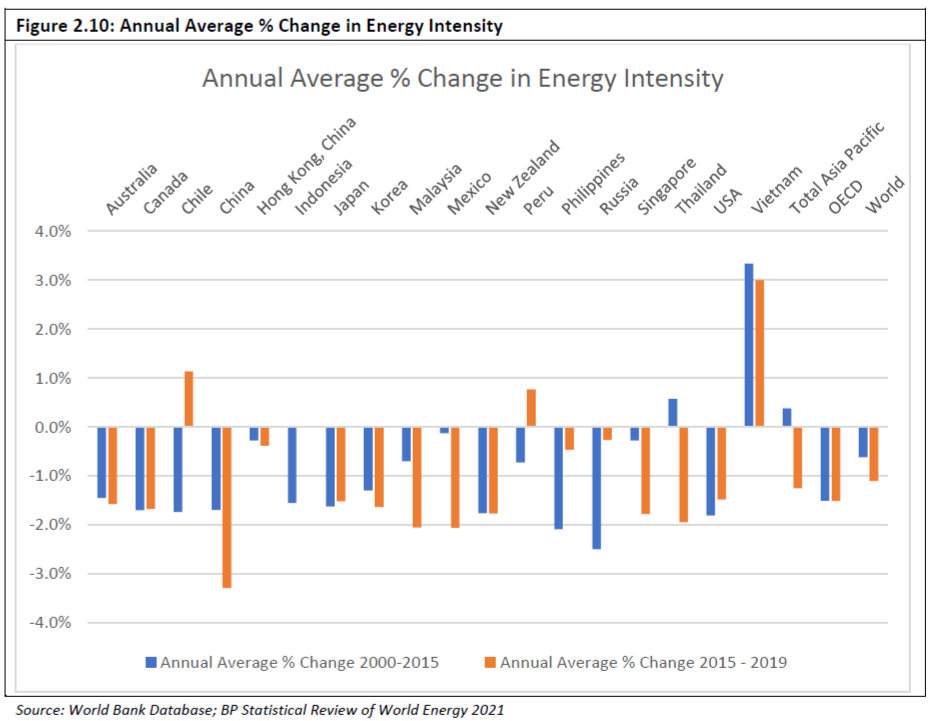

Figure 2.10 compares annual average % changes in energy intensities for two periods, 2000-2015 and 2015 – 2019. Global energy intensity improved 0.6% in the earlier period, and almost doubled this rate of improvement in the 4 years before the on-set of the covid pandemic in 2020. The OECD group improved its ratio at the same rate over both periods at 1.5% annual average. Australia, Canada, Japan, Korea, New Zealand, and the US improved at either similar or somewhat higher rates than the OECD average. Among the OECD members, Canada, New Zealand and the US exceeded the OECD average improvement in energy intensity the most during the 2000-2015 period.

In the non-OECD group, China, and Indonesia improved their annual average percentage change in energy intensity during 2000 – 2015 by between 1.6% to 1.7%, which is more than double the world’s 0.6% rate. Strikingly, during the same period, the Philippines and Russia improved their ratio by 2.1% and 2.5% respectively, most likely as a result of rapid economic growth (the denominator) and improved manufacturing processes and/or expansion of the services sector relative to manufacturing in their economies.

Hong Kong (China), Malaysia, Mexico and Singapore showed the lowest improvements, with annual rates ranging from 0.1% to 0.3% during 2000 – 2015. Only two economies showed a worsening in the annual average % change in the ratio during this period, with Thailand increasing by 0.6% and Vietnam by a remarkably high 3.3%. This is most likely due to their rapid growth in manufacturing and a sectoral shift from rural agriculture to urban manufacturing for significant proportion of the population.

When we turn to the more recent period from 2015 – 2019, the picture dramatically changes for many of the economies. Two economies, Chile and Peru show an increase in the ratio after the improvement in the previous period, at 1.1% and 0.8% respectively, that is a reversal in trend. Vietnam continued to show a worsening in energy intensity in the later period but at a slightly lower rate (from 3.3% to 3.0%). Some economies however show significant improvement in their performance relative to the earlier period, including China, Malaysia, Mexico and Singapore. Most show broadly similar or somewhat better rates of falling energy intensity in the more recent period relative to the previous: Australia, Canada, Hong Kong, Japan, New Zealand, and the US The global average showed a significant improvement in annual reduction of energy intensity, from 0.6% to 1.1%.

Given the very broad nature of the measure of energy efficiency implied by the economy-wide energy intensity metric, this heterogeneity of results is no surprise. From the standpoint of reducing greenhouse gas emissions, however, the relevant indicator is energy consumption, or more accurately, fossil fuel combustion, and it does not necessarily matter whether the target is achieved through energy efficiency improvements or through compositional changes in the economy towards less energy-intensive industries.

Using simple energy/GDP ratios to compare even proximally the energy efficiency levels across economies is, however, misleading. Such ratios conflate different effects, including the evolving composition of economies towards less energy-intensive sectors, the impact of price trajectories of various energy fuels and of rising incomes of households and firms in growing economies.

Energy efficiency policies and measures in the Asia-Pacific

Given the consistent and long running policy emphasis on energy efficiency across the Asia-Pacific region, the descriptive literature on the subject is voluminous.106 In its dedicated webpage on energy efficiency, the IEA has collated among the most comprehensive databases of energy efficiency initiatives undertaken by governments in both the OECD and non-OECD regions of the world. The IEA’s energy efficiency database lists “policies and measures” under 6 categories:

- economic instruments;

- policy support;

- regulatory instruments;

- information and education;

- research, development and

- deployment (RD&D).107

The sector targets for such “policies and measures” in the database include buildings, commercial and industrial equipment, energy utilities, industry, lighting, residential appliances, and transport. While sector-focused policies might have some common regulatory features, economies have typically implemented a distinct set of policies for each sector, rather than applying the same set of policies across all sectors.

Buildings

According to the United Nations Environment Program (UNEP), buildings and their construction together account for 36 percent of global energy use and 39 percent of energy-related carbon dioxide emissions annually.108 Most OECD members have mandatory codes for new and existing buildings, and such standards are being increasingly implemented in developing economies.

The most significant among such regulations are building energy codes i.e. energy efficiency requirements for new buildings where it is much less costly to integrate energy efficiency design and equipment improvements. Building energy codes can also serve as the efficiency target for refurbishments or other improvements of existing buildings.109

Most APEC economies had already long implemented building energy codes, although there are significant differences in coverage (residential vs. commercial buildings) and compliance mechanism (voluntary vs. mandatory codes).110 In addition, a range of other policies have been used to promote energy efficiency improvements in buildings, including energy performance labeling, financial incentives, energy management and audits, lead-by-example programs (such as government ‘test-beds’ and demonstration projects), information and awareness programs, and research and development (R&D) programs.111

Appliances

The technical potential for energy efficiency improvements in appliances is considerable according to engineering studies. According to one early report published in 2010, energy efficient standards and labeling programs aimed at improving the energy efficiency of equipment (including both appliances and lighting) can potentially lead to savings of 3,860 TWh of electricity by 2030.112 To put that in context, the world’s total electricity generation in 2010 was 21,325 TWh.113

It is not clear whether energy efficiency improvements in appliances in industrialized economies in the past 30 years have been driven primarily by efficiency standards, labeling, and incentive schemes. It is also a function of R&D focused on reducing running costs of such appliances and hence gaining market share among consumers. Nevertheless, government policies and regulations might have had a tangible influence on appliance energy efficiency.114 There has been a proliferation of energy efficiency standards and labeling programs around the world, rising from only 12 in 1990 (largely concentrated in industrialized economies) to more than 60 by 2005.115

Transport

Transportation accounted for approximately almost 25% of global carbon emissions in 2018 (see Table 2.3). All transport modes are projected to show substantial increases in activity and fuel use. In the future the impact of increased sales of electric vehicles in road transport vary widely (this is discussed on the section on electric vehicles). Oil is expected to continue to dominate overall transport energy and oil use to 2050.116

The IEA noted previously that policies that help to improve vehicle fuel economy are one of the most cost-effective measures for achieving an overall CO2 reduction target of 50% below 2005 levels by 2050 across the transport sector, although now it advocates for rapid electrification of transport and banning the use of the internal combustion engine (ICE).117 Most OECD members, including the EU and Japan, have pursued improvements in fuel efficiency of internal combustion engine vehicles via high levels of indirect taxes on gasoline and diesel sales.

In contrast, the US has very low rates of tax on transport fuels. Whereas the highest fuel taxes and prices tend to be in Europe, the US has both the lowest tax and the lowest fuel price among the OECD members. Instead, the US has pursued energy efficiency improvements primarily through mandated fleet efficiency standards on manufacturers, known as the Corporate Average Fuel Economy (CAFE) standards that were first implemented in 1975.118 As covered in the discussion on EVs below, the US along with Europe has switched policies in favor of EVs

APEC member economies have increasingly cut back on subsidies for transport fuels which cause wasteful inefficiencies and a burden on the public. This is in line with the APEC policy position to “Rationalize and phase out inefficient fossil-fuel subsidies that encourage wasteful consumption, while recognizing the importance of providing those in need with essential energy services, and set up a voluntary reporting mechanism on progress, which we will review annually”.119

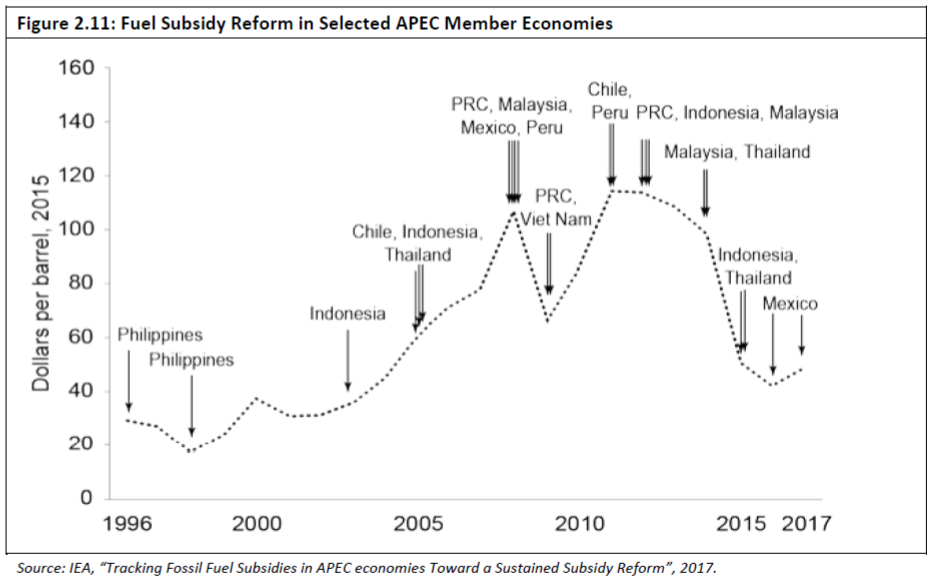

The economic impact had been especially significant given that subsidies amounted to between 1-5% of GDP in most Asia-Pacific economies (such as Indonesia and Malaysia).120 Subsidies reform have taken place in several APEC member economies over the past several years, as Figure 2.11 shows. The collapse of oil prices after mid-2014, in particular, gave governments an opportunity to cut back on transport fuel subsidies without too much impact on end-user prices.121

Industry

In 2018, the industrial sector (excluding the energy transformation sector, such as refineries and power plants) accounted for over 18% of global CO2 emissions (see Table 2.3). The energy transformation sector, which converts primary energy stored in energy sources (e.g. fossil fuels) into final energy for end-use sectors (in the form of refined fuels, electricity, etc.), is itself a major user of energy, accounting for 31% of the total primary energy consumption in the world in 2010.122 In spite of this, the bulk of global energy efficiency policy efforts have centered on non-industrial energy use, in part because of the extreme heterogeneity of the industrial sector, ranging from such energy-intensive sectors such as cement and steel plants to energy utilities and other heavy industry sectors.123

Several economies have also implemented policies specifically directed towards improving power generation efficiency. This is motivated by the fact that globally, the power and heat generation sector accounts for over 40% of CO2 emissions (see Table 2.3). These policies include in particular utility demand-side management (DSM) programs. Under these programs, utilities are required to operate energy efficiency programs, for instance by adopting time-of-use pricing to discourage peak demand or by providing cash incentives to consumers to reduce electricity demand when requested.124 In economies where power generation is based on subsidized tariffs for retail users or subsidized feedstock for the power generators, there may be few incentives for efficiency improvements. The strain on public budgets can be further exacerbated by the lack of cost recovery in regulated power generation markets in many developing APEC member economies.

Assessing energy efficiency policies in the Asia-Pacific region

Competitive markets help maximize the benefits of resource use across society by providing a mechanism to allocate these resources to the highest value user. But markets can fail to achieve this outcome due to market failures such as public goods, externalities or increasing returns to scale. The rationale for government intervention in a market-based economy rests on evidence of some type of market failure.125 Two fundamental attributes are necessary for any successful regulatory intervention in market-based economies: (1) administrative and political viability; and (2) economic efficiency. Assuming that the higher-order requirement of viability is met, the focus then is on economic efficiency. The basic test of economic efficiency is cost-benefit analysis (CBA) which is also the basis of conducting what have been termed “regulatory impact assessments”.

The ‘energy efficiency gap’ and government policy

Despite the vital role energy efficiency plays in cutting fossil fuel use cost-effectively, it is claimed that “only a small part of its economic potential is exploited”.126 The fact that cost-effective options to improve energy efficiency are not being adopted on a large scale has led to notions of the “energy-efficiency gap”. The ‘efficiency gap’, or the difference between the level of energy-efficiency actually achieved and the level judged to be optimal at prevailing prices, has generated considerable debate in policy circles as well as in the academic literature. This paradox – the non-adoption or slow diffusion of apparently cost-effective energy efficient technologies – has been the basis of a large literature on ‘market barriers’ which discourage investments in such technologies.127 The notion of “barriers” to energy efficiency choices, understood as market conditions which discourage energy efficiency investments relative to an estimated optimal level, is a staple of many large scale studies of energy efficiency. The primary barrier is insufficient implementation of existing cost-efficient technologies.”128 The IEA observed that “the existence of a number of barriers that discourage decision makers, such as households and firms, from making the best economic choices”.129

As noted in the previous section, APEC members have invested considerable efforts in the promotion of energy efficiency. The wide-range of government energy efficiency policies and initiatives implemented can be broadly classed under three types of policy or regulatory instruments: subsidies, technology or performance-based standards, and information and labeling programs.

Subsidies

Governments in the region have implemented a range of financial incentives and other subsidies such as cash grants, cheap credit, tax exemptions and co-financing with public-sector funds to encourage a range of energy efficiency initiatives across several sectors. Subsidies for building retro-fit and home insulation, tax exemptions or cash grants for upgrading of industrial machinery, subsidies to households and firms to purchase energy efficient appliances, heating or air-conditioning systems and other equipment are typical examples.

Another rationale for government subsidies and financial incentives for encouraging energy efficiency investments relates to the claim that consumers have high discount rates – that is, they typically put too little weight on future energy savings, and too much on upfront costs, when buying energy efficient appliances. Uncertainty over future energy savings, hidden costs such as costs of searching new products or reductions in other desirable product characteristics, the irreversibility of investments and the associated option value of waiting, are some of the reasons offered by economists to explain high discount rates.

Mandated Standards

Governments have implemented a vast array of standards based on technology or performance-based criteria to promote energy efficiency. Building codes, minimum energy performance standards for energy-using consumer durables, and standards for fuel efficiency in automobiles in the US are some of the more obvious examples of government-mandated standards. These standards are usually implemented on the basis of cost-benefit analyses which purport to show net benefits which result from restricting private choices by mandatory standards.

Labels and information programs

There is a class of market failures arising from information asymmetry, where one party to a transaction has more or better information than the other party. The principal–agent problem describes a situation where one party (the agent), a builder or landlord, decides the level of energy efficiency in a building, while a second party (the principal), such as the purchaser or tenant, pays the utility bills.130 A first-best policy solution for this sort of market failure could be the provision of credible information by a disinterested 3rd party (possibly a government agency) about a building’s energy attributes, so that buyers or renters can credibly ascertain the present value of net energy savings (under given fuel price scenarios).

Perhaps the most fundamental observation on optimal energy efficiency policy is that energy conservation cannot be mandated or imposed centrally, but requires information and incentives to be provided to energy users who make their own choices and adjustments. If households and firms are poorly informed about energy efficiency improvements that can be profitably exploited, an information disclosure policy is appropriate. It thus behooves analysts to assess government energy efficiency policies with a high degree of clarity as to what constitutes costs and benefits as perceived by private decision-makers, and why they could systematically diverge from expert views of costs and benefits.